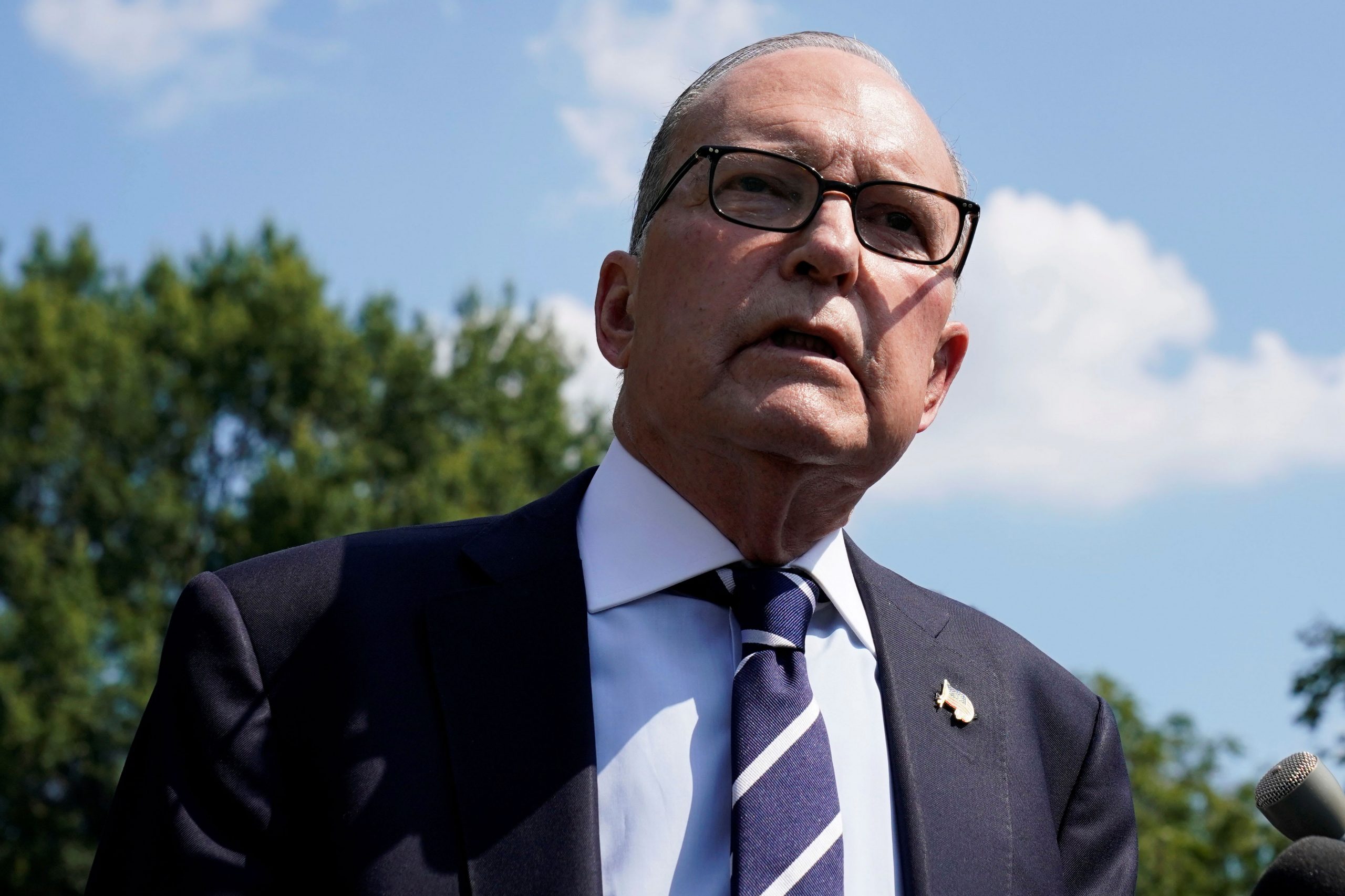

National Economic Council Director Larry Kudlow, a top economic adviser to President Donald Trump, said Wednesday that the White House plans to unveil a plan for additional tax cuts later in 2020.

“I am still running a process of Tax Cuts 2.0. We’re many months away – it’ll come out sometime later during the campaign,” Kudlow told CNBC. “Tax Cuts 2.0 to help middle-class economic growth: That’s still our goal.”

“I had a tremendous meeting with my friend Kevin Brady, who will undoubtedly be the new chairman of the House Ways and Means Committee,” he added. “But we will unveil this perhaps sometimes later in the summer.”

As one of the Trump administration’s biggest victories of the president’s first term in office, the 2017 Tax Cuts and Jobs Act lowered the U.S. corporate tax rate to 21% and cut rates for closely held businesses. The legislation effectively allowed businesses to keep more of what they deliver in profits, an outcome that proponents say will continue to drive job growth and investment.

But the White House has in recent months explored a second round of tax cuts focused on boosting take-home earnings for the middle class, an initiative Kudlow has thus far spearheaded. Fox Business News first reported on the schedule of the White House’s plan for a second round of tax cuts.

“This thing will not be completed for many months and it will be released as a strategic pro-growth document for the campaign,” Kudlow said in November. “We want to see middle-income taxpayers get the lowest possible rates.”

He also said at the time: “Whether we get to 15% on a middle-class tax rate — I don’t know. Sounds like a pretty good idea to me.”

That may be in part to equalize some of the effect of the first round of tax cuts. Households with less than about $25,000 got an average tax cut of about $40, compared with about $33,000 in tax savings for those with $733,000 or more in income (the top 1%).

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals