Yen and Dollar trade broadly lower today while markets are having different reactions to US-China trade deal phase one, which was signed finally yesterday. Asian stocks were mixed while European stocks are soft. But US futures point to higher open, probably extending recent record runs, while 10-year yield is back above 1.8 handle. Australian and New Zealand Dollar are the strongest today. Swiss Franc is also firm as safe haven flows on Russia uncertainty continue.

Technically, AUD/USD breaches 0.6930 but cannot sustain above this minor resistance yet. As long as 0.6930 holds, we’d still expect another decline through 0.6849 to extend the fall from 0.7031. However, firm break of 0.6930 will revive near term bullishness for 0.7031 and above. This will be a focus in European session. EUR/JPY breaches 122.76 temporary top and should be trying to extend recent rise form 115.86. Yet, upside momentum is not too convincing for now.

In Europe, currently, FTSE is down -0.29%. DAX is down -0.02%. CAC is up 0.06%. German 10-year yield is down -0.012 at -0.209, back below -0.2 handle. Earlier in Asia, Nikkei rose 0.07%. Hong Kong HSI rose 0.38%. China Shanghai SSE dropped -0.52%. Singapore Strait Times rose 0.65%. Japan 10-year JGB yield rose 0.0019 to 0.009.

US retail sales rose 0.3%, ex-auto sales up 0.7%, initial jobless claims dropped to 204k

US retail sales rose 0.3% to USD 529.6B in December, matched expectations. Total sales for the 12 months of 2019 were up 3.6% from 2018. Ex-auto sales rose 0.7% mom versus expectation of 0.5% mom. Ex-gasoline sales rose 0.1% mom. Ex-auto and gasoline sales rose 0.5% mom.

Initial jobless claims dropped -10k to 204k in the week ending January 11, better than expectation of 220k. Four-week moving average of initial claims dropped -7.75k to 216.25k. Continuing claims dropped -37k to 1.767m in the week ending January 4. Four-week moving average of continuing claims rose 10.5k to 1.756m.

Philadelphia Fed Manufacturing Business Outlook jumped to 17.0 in January, up from revised 2.4 in December, beat expectation of 3.7. The percentage of the firms reporting increases (39 percent) was greater than the percentage reporting decreases (22 percent).

EU Hogan warned devil is in the detail in US-China trade deal

EU Trade Commissioner Phil Hogan sounded skeptical regarding US-China trade deal as he spoke in a press conference. he noted that “the devil is in the detail”, and “we will have to assess whether it is WTO compliant”.

Meanwhile, Hogan also sounded harsh against China as he complained that the EU is “very open” while China is not opening as promised. He added that China is looking for dominance, influence geopolitically through trade and investment. Also, EU cannot let Chinese dominance put EU companies out of business based on unfair subsidies.

Suggested reading on US-China trade deal: US-China Phase I Trade Deal Signed, Execution & Phase II Negotiations the Next Focus

ECB minutes: Policy rates not yet reached reversal rate

In the December 11-12 monetary policy accounts, ECB said incoming data since October pointed to “continued weakness” in Eurozone growth dynamics, but there were “some initial signs of stabilisation”. Inflation development remained “subdued overall” while there were “some indications of a slight increase in measures of underlying inflation in line with previous expectations.”

Policy makers were confidence that current monetary policy would “provide the necessary monetary stimulus” to support stabilization of growth. “Perceptions of receding uncertainties” regarding US-China trade dispute also supported positive market sentiments and equity prices.

There was “broad agreement” on the need to carefully monitor incoming data and evolution of risks. Some members highlighted the need to be “attentive to the possible side effects” of current policy measures. But “confidence was expressed that policy rates had not yet reached the so-called reversal rate”.

German BDI projects growth to slow to 0.5% in 2020

Germany’s BDI association expected growth to slow further in 2020 to 0.5%. After calendar adjustment, growth could be as low as 0.1%. President Dieter Kempf said “industry remains stuck in recession, there are no signs for the sector bottoming out.”

He called for the government to lower corporate taxes to push averaged burden from the current 31% to 24%. He also urged massive public infrastructure investment over the next 10 years to boost the economy.

Released earlier, Germany CPI was finalized at 0.5% mom, 1.5% yoy in December.

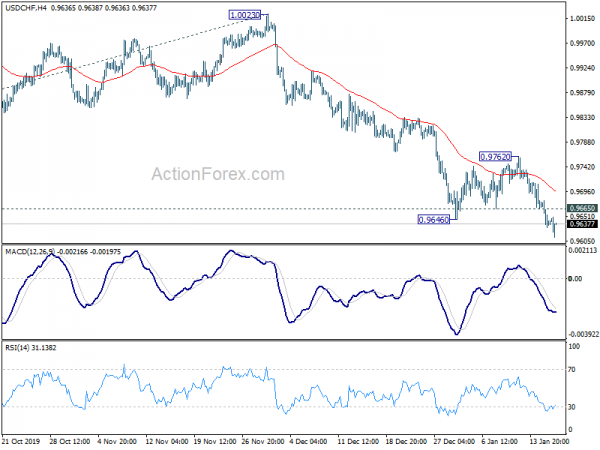

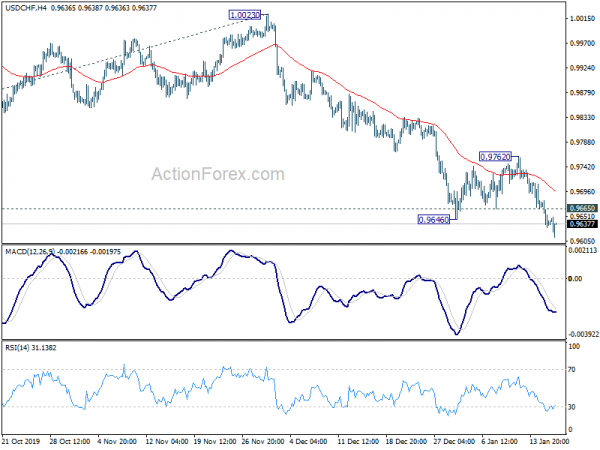

USD/CHF Mid-Day Outlook

Daily Pivots: (S1) 0.9621; (P) 0.9651; (R1) 0.9670; More…

USD/CHF’s fall is still in progress and intraday bias stays on the downside. Current down trend form 1.0237 should target 100% projection of 1.0237 to 0.9659 from 1.0023 at 0.9445. On the upside, above 0.9665 minor resistance will turn intraday bias neutral first. But break of 0.9762 resistance is needed to indicate short term bottoming. Otherwise, outlook will remain bearish in case of recovery.

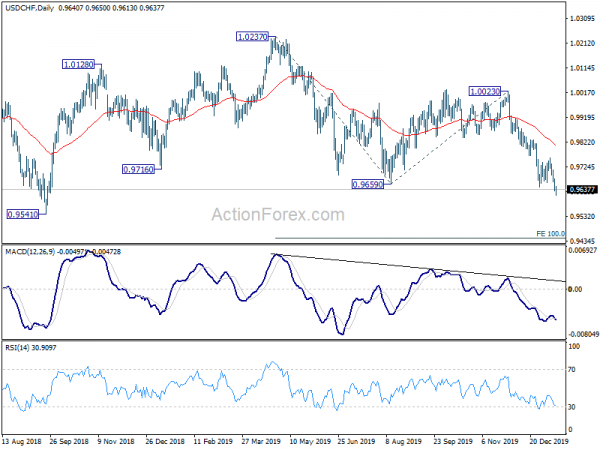

In the bigger picture, medium term outlook remains neutral as USD/CHF is staying sideway trading started from 1.0342 (2016 high). Fall from 1.0237 is a leg inside the pattern and could target 0.9186 (2018 low). In case of another rise, break of 1.0237 is needed to indicate up trend resumption. Otherwise, more sideway trading would be seen with risk of another fall.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 23:50 | JPY | PPI Y/Y Dec | 0.90% | 0.90% | 0.10% | |

| 00:01 | GBP | RICS Housing Price Balance Dec | -2% | -5% | -12% | -11% |

| 07:00 | EUR | Germany CPI M/M Dec F | 0.50% | 0.50% | 0.50% | |

| 07:00 | EUR | Germany CPI Y/Y Dec F | 1.50% | 1.50% | 1.50% | |

| 12:30 | EUR | ECB Monetary Policy Meeting Accounts | ||||

| 13:30 | USD | Retail Sales M/M Dec | 0.30% | 0.30% | 0.20% | 0.30% |

| 13:30 | USD | Retail Sales ex Autos M/M Dec | 0.70% | 0.50% | 0.10% | 0.00% |

| 13:30 | USD | Initial Jobless Claims (Jan 10) | 204K | 220K | 214K | |

| 13:30 | USD | Import Price Index M/M Dec | 0.30% | 0.30% | 0.20% | 0.10% |

| 13:30 | USD | Philadelphia Fed Manufacturing Survey Jan | 17 | 3.9 | 0.3 | |

| 15:00 | USD | Business Inventories Nov | -0.10% | 0.20% | ||

| 15:00 | USD | NAHB Housing Market Index Jan | 76 | 76 | ||

| 15:30 | USD | Natural Gas Storage | -91B | -44B |

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals