Dollar is trading with a mildly firm tone in Asian session today, riding on solid data from US released overnight. But there is no clear committed buying seen yet. Meanwhile, Australian and Canadian Dollars both turned weaker but New Zealand Dollar is trading higher broadly. Over the week, Yen is the weakest one with Aussie, while Swiss Franc is the strongest together with Euro. The overall picture in the forex market is rather mixed. Also, US indices hit new records highs overnight, but Asian markets are mixed.

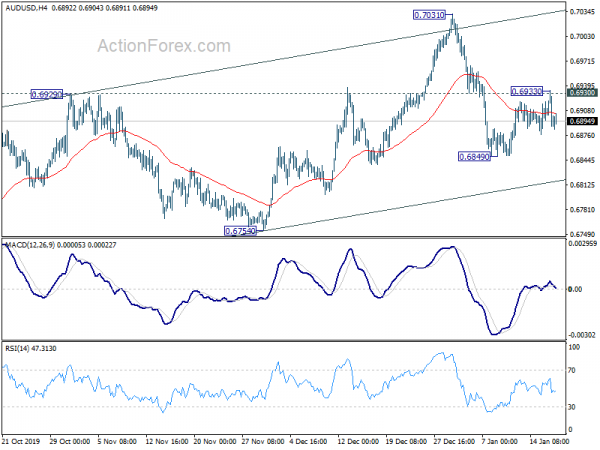

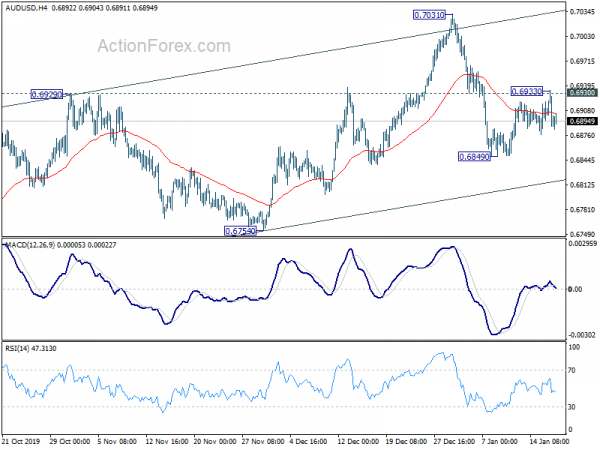

Technically, USD/JPY’s break of 110.21 temporary top suggests resumption of recent up trend. Further rise would be seen to 110.89 projection level next. AUD/USD failed to sustain above 0.6930 minor resistance and could be heading back to 0.6849. AUD/NZD’s recovery from 1.0315 should be finished at 1.0458. Further decline is likely back to 1.0315 and break there could be an early sign of more selling in Aussie elsewhere, like AUD/USD.

In Asia, currently, Nikkei is up 0.49%. Hong Kong HSI is down -0.05%. China Shanghai SSE is up 0.24%. Singapore Strait Times is down -0.03%. Japan 10-year JGB yield is down -0.0024 at 0.009. Overnight, DOW rose 0.92%. S&P 500 rose 0.84%. NASDAQ rose 1.06%. 10-year yield rose 0.021 to 1.809.

US Senate passed USMCA, Canada next

US Senate approved the US-Mexico-Canada Agreement yesterday with 89-10 vote. House already passed the legislation on December 19. The USMCA will now be sent to President Donald Trump for signing into law.

Treasury Secretary Steven Mnuchin hailed, “this historic agreement not only modernizes and rebalances our trade relationship with Canada and Mexico, but it promotes economic growth, creates jobs, and provides crucial certainty for farmers, workers and manufacturers.”

Canada is the only country which hasn’t ratified the agreement yet. The parliament does not return to session until January 27 and, for now, the schedule remains unclear. But little resistance is expected as both Liberal and Conservatives should back it.

China GDP grew 6.0% in Q4, 6.1% in 2019 overall

China’s GDP grew 6.0% yoy in Q4, matched market expectations. Overall growth in 2019 was at 6.1%, slowed from 2018’s 6.6%. That’s the slowest annual growth since 1990. In December, industrial production grew 6.9% yoy, above expectation of 6.2% yoy, strongest pace in nine months. Retail sales rose 8.0% yoy, above expectation of 7.9% yoy. Fixed asset investment rose 5.4% ytd yoy, above expectation of 5.2%.

The set of data suggests stabilization in the Chinese economy. Yet, there is question regarding the sustainability, not to mention the chance of a rebound. US-China trade deal phase one should provide some short-term support. But uncertainties lie in the medium to long term we core issues to be resolved with the US in phase two negotiations. At the same time, large chunk of the tariffs remains in place.

New Zealand BusinessNZ manufacturing index dropped to 49.3

New Zealand BusinessNZ Manufacturing Index dropped to 49.3 in December, down from 51.2. That’s the second consecutive decrease and the lowest reading since September. NZ Senior Economist, Craig Ebert said that “the December result was disappointing. After a couple of months flirting with positivity, the PMI dipped back just below the breakeven line again”.

Looking at some details, production dropped from 49.4 to 48.2. Employment rose from 49.1 to 49.9 but stayed below 50. New orders dropped from 54.0 to 51.0. Finished stocks jumped from 49.2 to 52.0. Delivers dropped from 52.6 to 50.7.

Looking ahead

Swiss will release PPI in European session while Eurozone will release current account and CPI final. But main focus will be on retail sales. Later in the day, Canada will release foreign securities pruchases. US will release housing starts and building permits, industrial prodcution and U of Michigan consumer sentiment.

AUD/USD Daily Report

Daily Pivots: (S1) 0.6879; (P) 0.6906; (R1) 0.6925; More…

AUD/USD recovered to 0.6933 but failed to sustain above 0.6930 minor resistance. Intraday bias remains neutral and further decline is still expected. As noted before, rebound from 0.6670 could have completed with three waves up to 0.7031. On the downside, break of 0.6849 will target 0.6754 support to confirm this bearish case. However, firm break of 0.6930 will turn focus back to 0.7031 resistance instead.

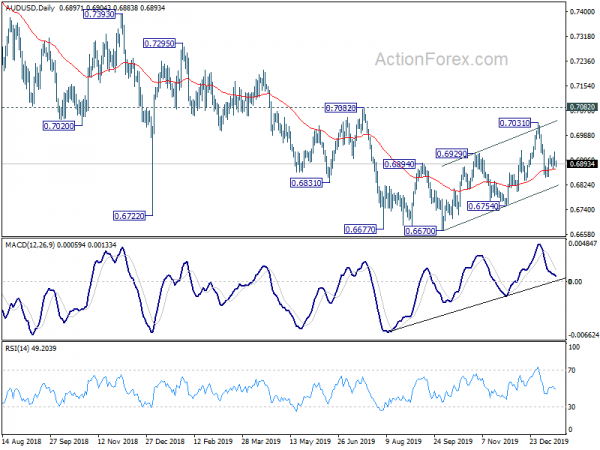

In the bigger picture, with 0.7082 resistance intact, there is no clear confirmation of trend reversal yet. That is, down trend from 0.8135 (2018 high) is still expect to continue to 0.6008 (2008 low). However, decisive break of 0.7082 will confirm medium term bottoming and bring stronger rally back to 55 month EMA (now at 0.7487).

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 21:30 | NZD | Business NZ Manufacturing Index Dec | 49.3 | 51.4 | 51.2 | |

| 2:00 | CNY | GDP Y/Y Q4 | 6.00% | 6.00% | 6.00% | |

| 2:00 | CNY | Retail Sales Y/Y Dec | 8.00% | 7.90% | 8.00% | |

| 2:00 | CNY | Industrial Production Y/Y Dec | 6.90% | 6.20% | 6.20% | |

| 2:00 | CNY | Fixed Asset Investment YTD Y/Y Dec | 5.40% | 5.20% | 5.20% | |

| 4:30 | JPY | Tertiary Industry Index M/M Nov | 1.00% | -4.60% | ||

| 7:30 | CHF | Producer and Import Prices M/M Dec | 0.00% | -0.40% | ||

| 7:30 | CHF | Producer and Import Prices Y/Y Dec | -2.50% | -2.50% | ||

| 9:00 | EUR | Eurozone Current Account (EUR) Nov | 34.3B | 32.4B | ||

| 9:30 | GBP | Retail Sales M/M Dec | 0.80% | -0.60% | ||

| 9:30 | GBP | Retail Sales Y/Y Dec | 1.00% | |||

| 9:30 | GBP | Retail Sales ex-Fuel M/M Dec | -0.60% | |||

| 9:30 | GBP | Retail Sales ex-Fuel Y/Y Dec | 0.80% | |||

| 10:00 | EUR | Eurozone CPI Y/Y Dec F | 1.30% | 1.30% | ||

| 10:00 | EUR | Eurozone CPI Core Y/Y Dec | 1.30% | 1.30% | ||

| 13:30 | USD | Building Permits Dec | 1.47M | 1.48M | ||

| 13:30 | USD | Housing Starts Dec | 1.38M | 1.37M | ||

| 13:30 | CAD | Foreign Securities Purchases (CAD) Nov | 12.32B | 11.32B | ||

| 14:15 | USD | Industrial Production M/M Dec | 0.00% | 1.10% | ||

| 14:15 | USD | Capacity Utilization Dec | 77.20% | 77.30% | ||

| 15:00 | USD | Michigan Consumer Sentiment Index Jan P | 99.4 | 99.3 |

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals