Dollar, Canadian and Yen are so far the strongest ones in a relatively quiet day. The greenback is supported by recent data as well as easing trade tension. But as the US economic calendar is ultra light this week, Dollar’s fate is likely on others’ hands. Canadian Dollar is supported by oil prices, which surged on double-whammy production disruption in Libya and Iraq. On the other hand, Sterling is extending recent broad based weakness on BoE rate cut speculations.

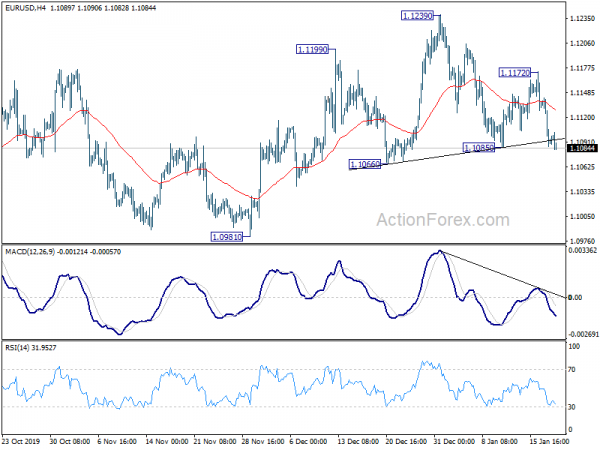

Technically, focus stays on 1.1085 support in EUR/USD, which is breached already. Sustained break will complete a head and shoulder top pattern, which should at least turn outlook bearish for 1.0981 support. However, USD/JPY is clearly losing upside momentum, following other Yen crosses like EUR/JPY and GBP/JPY. Break of 109.79 support in USD/JPY will indicate short term topping and bring deeper pull back. That could limit downside of EUR/USD.

In Europe, currently, FTSE is down -0.16%. DAX is up 0.11%. CAC is down -0.19%. German 10-year yield is up 0.003 at -0.207. Earlier in Asia, Nikkei rose 0.18%. Hong Kong HSI is down -0.90%. Shanghai SSE rose 0.66%. Singapore Strait Times dropped -0.03%. Japan 10-year JGB yield rose 0.0083 to 0.009.

Bundesbank: Increasing evidence of stabilization in manufacturing sector

In the monthly report, Bundesbank said domestic economy was strong even though the overall economy probably stagnated in Q4. There is still no sign of an end to the boom in construction, which benefited from positive income prospects and favorable financing conditions.

Downward movement in the export-oriented industry continued. But there was increasing evidence of stabilization in the manufacturing sector. Industrial orders have not deteriorated further in the past few months. Goods export also increased significantly. Short-term export expectations recovered and returned to positive territory for the first time in six months.

France Le Maire: Strike has very limited impact on GDP

France Economy Minister Bruno Le Maire said the economic impact of strike, which is in its 46th day, will be limited. But still, it could cut Q3 GDP growth by -0.1%. He told LCI television: “There will be an impact but it will be, I think, limited. Today estimates available show that the impact would be of a 0.1 points on growth on a quarter. On the whole year, it is a very limited impact.”

China: Pressure on stabilizing industrial growth is still big

China’s Minister of Industry and Information Technology spokesperson Miao Wei said the government will continue with tax and fee reductions in 2020 to support growth. Focus will be on manufacturing sector, with increase in research and development investments.

Miao said “looking forward to 2020, industrial development faces many difficulties and risks,” and “pressure on stabilizing industrial growth is still big.” But the government will be able to “ensure the smooth operation of the industrial economy” with the above efforts.

On 5G technology, Miao said more than 130,000 base stations were built by the end of last year. 35 mobile phone terminals received network access licenses. More than 13.77m 5G phones were made. These phones are expected to cost less than CNY 1500 in Q4.

Japan PM Abe said South Korea is the most important neighbor sharing basic values and strategic interests

Japanese Prime Minister Shinzo Abe offered some warm words to South Korea today, suggesting both sides are moving towards normalization of relationship. He upgraded description of South Korea from an “important neighbor” to “the most important neighbor” who “shares basic values and strategic interests.”

Abe told the parliament that “under an increasingly severe security environment in Northeast Asia, diplomacy with neighboring countries is extremely important”. And, “essentially, South Korea is the most important neighbor with which Japan shares basic values and strategic interests.”

Abe also urged to leave the issues of wartime labor behind. And, “I sincerely hope South Korea honors the commitments between the two counties and works toward building future-oriented relations.”

EUR/USD Mid-Day Outlook

Daily Pivots: (S1) 1.1070; (P) 1.1106; (R1) 1.1127; More…

Focus remains on 1.1085 support in EUR/USD. Sustained break will complete a head and shoulder top (ls: 1.1199, h: 1.1239, rs: 1.1172). That will also argue that whole corrective rise from 1.0879 has completed. In this case, intraday bias will be turned to the downside for 1.0981 support for confirmation. On the upside, above 1.1172 will turn bias to the upside for 1.1239 instead.

In the bigger picture, rebound from 1.0879 is seen as a corrective move at this point. In case of another rise, upside should be limited by 38.2% retracement of 1.2555 to 1.0879 at 1.1519. And, down trend from 1.2555 (2018 high) would resume at a later stage. However, sustained break of 1.1519 will dampen this bearish view and bring stronger rise to 61.8% retracement at 1.1915 next.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 0:01 | GBP | Rightmove House Price Index M/M Jan | 2.30% | -0.90% | ||

| 4:30 | JPY | Industrial Production M/M Nov | 1.00% | -0.90% | -0.90% | |

| 7:00 | EUR | Germany PPI M/M Dec | 0.10% | 0.10% | 0.00% | |

| 7:00 | EUR | Germany PPI Y/Y Dec | -0.20% | -0.60% | -0.70% | |

| 11:00 | EUR | German Buba Monthly Report |

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals