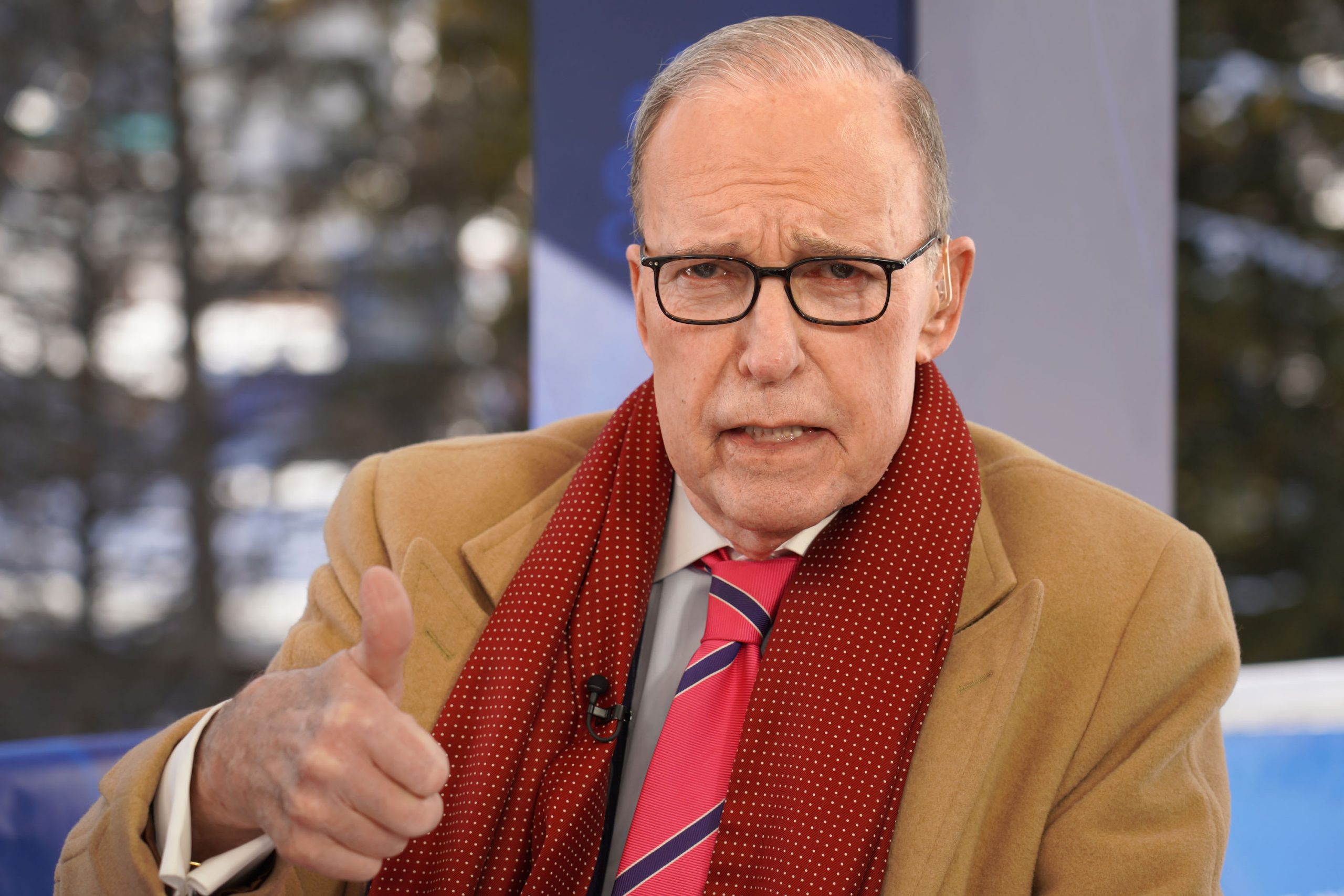

President Donald Trump’s top economic advisor, Larry Kudlow, told CNBC on Tuesday that GDP growth in the U.S. should hit at least 3% in 2020.

“This is a long cycle, and what you’ve got here in the Trump years is essentially a mini upcycle,” said Kudlow, National Economic Council director. “You’ve gone from 1.5% to 2% growth. We had it going at almost 4%, then the Fed tightened.”

“We’re now down to 2.5% to 3%. I’m looking for faster growth: I think we’re going to get 3% this year,” he added. “The trade deals will help, the Fed changed policy — that was very, very important.”

Some investors worried in 2019 that pressure from the U.S.-China tariffs, a decelerating global economy and low inflation levels would cut short a year that started off with a 3.1% GDP gain. But with two new major trade deals and new predictions for a global recovery in 2020, sentiment appears to be improving.

Stronger manufacturing and trade data released earlier this month suggested the U.S. economy ended 2019 on a healthy note, with expectations that the economy will grow more than 2% in the fourth quarter. While that would represent a slowdown from the 2.9% increase in 2018, 2% growth would still suggest the decade-old expansion is set to continue into 2020.

Globally, the most recent indication for better growth came from the International Monetary Fund, which earlier this week said it sees growth running at 3.3% in 2020, up from 2.9% in 2019.

But Kudlow’s June prediction that U.S. growth would maintain its 3% rate in 2019 will likely fall short when the Commerce Department releases its fourth-quarter numbers later this year.

Economic growth slumped to 2% in the second quarter and 2.1% in the third quarter, according to government data. That would make it extremely tough for the U.S. economy to hike its growth for the year above 3%.

Earlier this year, the president’s economic advisor told CNBC that “That 3% number is not contingent on a China deal that might be satisfactory for American economic interests.”

“What has changed,” he said in June, “is lower tax rates, massive deregulation, opening up the energy sector and various trade reforms.”

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals