Key Highlights

- Crude oil price is declining and it recently settled below $60.00 against the US dollar.

- Earlier, there was a break below a key bullish trend line with support near $61.35 on the 4-hours chart of XTI/USD.

- GBP/USD is extending its recovery, while EUR/USD is still facing many hurdles.

- The US Initial Jobless Claims could increase from 204K to 215K for the week ending Jan 18, 2020.

Crude Oil Price Technical Analysis

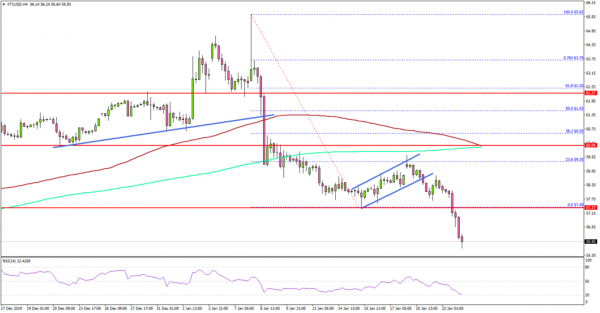

After topping near the $65.65 level, crude oil price started a strong decline. There was a break below the $62.50 and $61.20 support levels to initiate a fresh bearish wave.

Looking at the 4-hours chart of XTI/USD, the price even settled below the $60.00 support area, the 100 simple moving average (red, 4-hours), and the 200 simple moving average (green, 4-hours).

It opened the doors for more losses and the price broke the $60.00 support. A swing low was formed near $57.40 before the price corrected above the $58.50 area.

However, the upward move was capped by the $59.50 area, plus the 23.6% Fib retracement level of the major decline from the $65.65 high to $57.40 low. Recently, the price resumed its decline and broke the $57.40 low. It even traded below the $57.00 and $56.20 support levels.

If there is a downside break below $55.00, the bears could push the price below the $54.50 and $54.00 support levels. In the mentioned case, crude oil price might even test the $52.00 support area.

On the upside, an initial hurdle is near the $57.40 area. However, the main resistance is near the $60.00 level and the 100 simple moving average (red, 4-hours).

Therefore, a successful close above $60.00 and $60.50 is needed to start a decent bullish wave. If not, the price remains at a risk of more downsides in the coming sessions.

Looking at major pairs, EUR/USD failed to correct above the 1.1130 level, but GBP/USD recovered nicely above the 1.3100 resistance.

Economic Releases to Watch Today

- ECB Interest Rate Decision – Forecast 0%, versus 0% previous.

- US Initial Jobless Claims – Forecast 215K, versus 204K previous.

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals