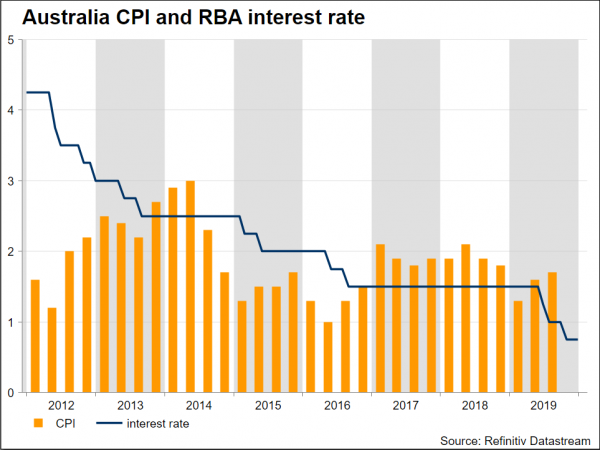

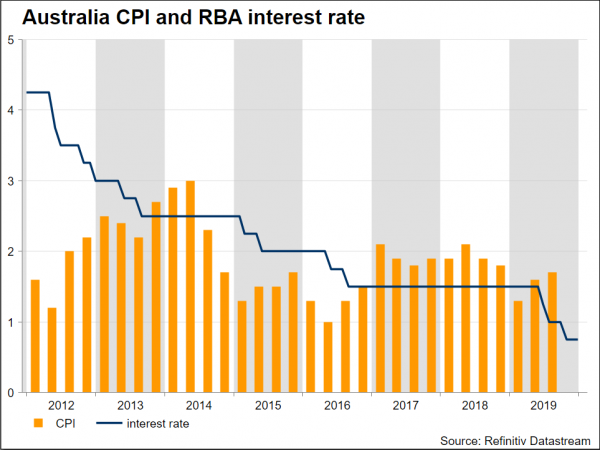

Early on Wednesday at 0030 GMT, Australia will publish its inflation numbers for the fourth quarter of 2019. Forecasters expect inflation to remain steady at 1.7% as before on a yearly basis. On a quarterly basis, the pace of consumer price increases is predicted to tick higher to 0.6% from 0.5% prior.

The view is that the Reserve Bank of Australia (RBA) will probably postpone its next rate cut to April with the final cut to 0.25% occurring in August. This looser policy is expected following devastating bushfires. The next policy meeting is taking place on February 4 at 0330 GMT.

However, before the surprisingly strong employment numbers rate for December, rate cuts were expected to be timed for February and June. The unemployment rate declined to 5.1% in December from 5.2% in the previous month and below market expectations of 5.2%, which is the lowest jobless rate since March. It is worth mentioning that Philip Lowe, Reserve Bank Governor has stated that the economy should be aiming at an unemployment rate of 4.5%, which would assist the objective of boosting wages growth, income growth, consumer spending and inflation.

The Inflation Report is predicted to print 0.4% q/q for the trimmed mean pushing the annual rate down to 1.5% from 1.6% – well short of the 2–3% target inflation range. Previously, the Q3 CPI lifted to a quarterly 0.5% compared to the annual rate of 1.7% y/y, from 1.6%, and while this represents a modest acceleration from 1.3% y/y in Q1, it remains below the bottom of the RBA’s target band. In case that GDP growth remains below trend, it is expected that the current momentum in the labour market will prove unsustainable and the unemployment rate could rise to 5.5% mid-year. Without a stronger labour market, wage growth will remain weak and inflation will disappoint.

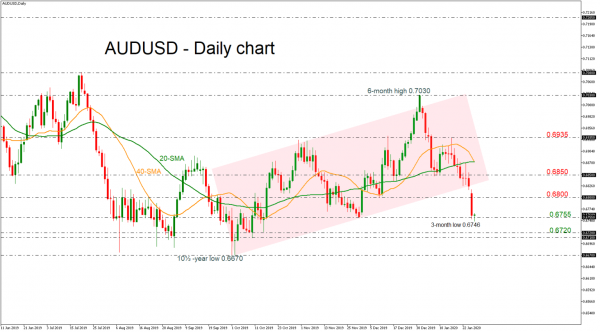

Aussie continues the strong sell-off

In FX markets, aussie/dollar has been under strong pressure from the beginning of the year. Currently, the pair declined to a fresh three-month low near 0.6746 and is expected to slip even lower.

Disappointing figures may increase speculation that the next move in rates could be down, sending the pair towards the 0.6755 support. Lower than that, eyes would turn to the 0.6710 – 0.6720 area before hitting the ten-and-a-half-year low of 0.6670.

Should inflation beat forecasts, aussie/dollar might extend gains towards the 0.6800 handle and the 0.6850 resistance level. A bigger surprise in the data, may also open the door for the 20- and 40- simple moving averages at 0.6880 and 0.6890 respectively.

Yet, investors might prefer to show patience until next week for the release of the RBA interest rate decision.

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals