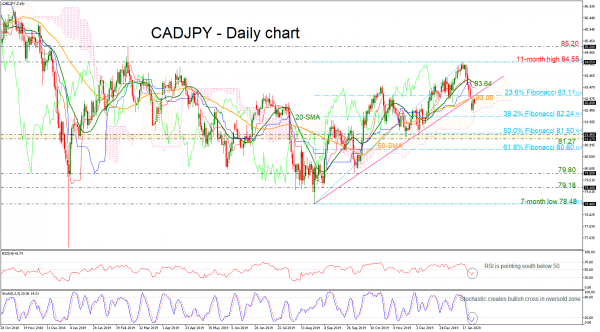

CADJPY found strong resistance from the 50-day simple moving average (SMA) and the 23.6% Fibonacci retracement level of the upward wave from 78.48 to 84.55 near 83.11 earlier today. Questions are rising now about whether the market can sustain the downtrend line break in the coming sessions.

The negative slope in the RSI, which runs comfortably below its 50 neutral mark is painting a bearish picture for the short-term trading. However, with the Stochastics searching for a bullish cross in the oversold area, it is reasonable to believe that the rally may appear short-lived.

Should weakness extend below the Ichimoku cloud, support to downside movements could be initially detected from the 50.0% Fibonacci of 81.50 to the 81.27 area but first it needs to overcome the 38.2% Fibonacci of 82.24. Clearing that zone, the next stop could be around the 61.8% Fibo of 80.80.

Alternatively, the pair needs to overcome the 23.6% Fibo of 83.11 to meet the 40-day SMA currently at 83.64. The eleven-month high of 84.55 could act as resistance too, before a more important battle starts near 85.20.

In brief, CADJPY is expected to continue the south-run in the short-term, while in the medium-term, buying interest could advance if the market surpasses the 85.20 resistance.

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals