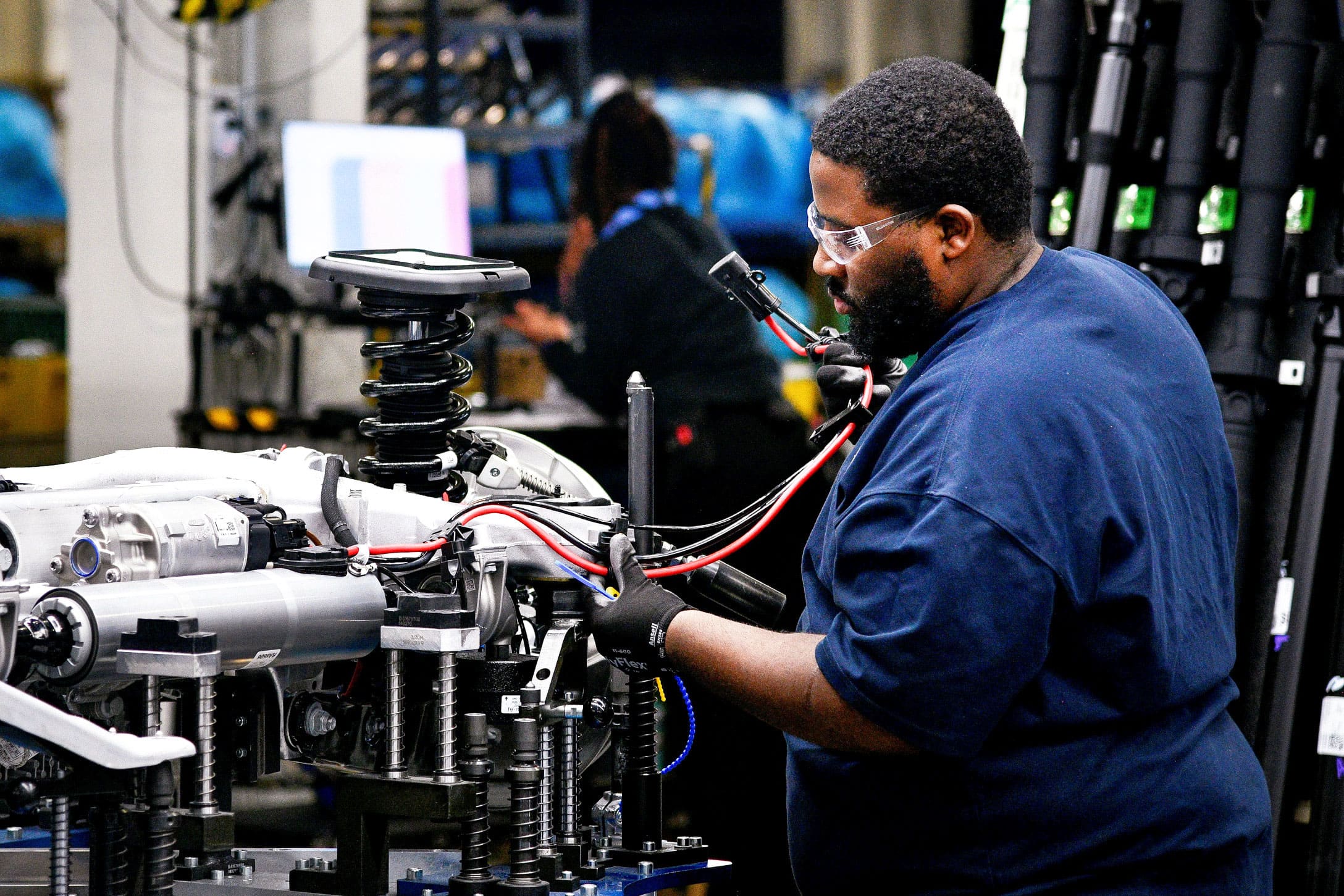

A worker attaches a wiring harness to the chassis of an X model SUV at the BMW manufacturing facility in Greer, South Carolina, November 4, 2019.

Charles Mostoller | Reuters

WASHINGTON — The U.S. economy grew 2.1% in the fourth quarter, closing out a year in which gross domestic product decelerated to its slowest pace in three years amid a continuing drag in business investment.

The GDP increase matched the third quarter and met expectations of economists surveyed by Dow Jones. For the full year, the economy grew 2.3%, below the 2.9% increase from 2018 and the 2.4% gain in 2017, the first year of Donald Trump’s presidency, according to the initial estimate released Thursday by the Commerce Department.

The move in 2019 was well below the White House’s projections following the 2017 tax bill that cut corporate and individual rates. The administration has said the stimulus would lead to GDP increases of at least 3%, but that hasn’t happened yet.

Continued gains in consumer spending helped propel the economy in the year’s final three months, though the rate of increase came in at 1.8%, well below the 3.2% pace in the third quarter. Still, personal consumption expenditures added 1.2 percentage points to the quarterly rise. The consumer accounts for 68% of what is now a $21.7 trillion U.S. economy.

For the full year, PCE rose 2.6%, off the 3% pace in 2018. Real disposable income was up 1.5% in the fourth quarter, a decline from the 2.9% rise in the previous period. The full-year gain came in a 3%, below the 4% increase in 2018. The savings rate was 7.7%, little changed from the third quarter.

Economists saw the Q4 numbers as reflective of a broader trend toward steady but slower growth.

“If we think of the economy as being roughly in equilibrium, the natural question is what it would take to shock the system,” Eric Winograd, senior economist at AllianceBernstein, said in a note. “For the moment, I think negative risks are more likely than positive ones. But with the economy as stable as it is, it would take a very large shock indeed to materially alter the economy’s basic trajectory.”

What helped and hurt growth?

Durable goods spending rose 1.2% while nondurables saw growth of 0.8%, the slowest pace since the first quarter of 2018. Net exports also helped, rising 1.4% amid the tariff war between the U.S. and China. Imports fell 8.7%, owing to a drop in consumer goods and motor vehicles, as the U.S. has made some inroads in cutting its global trade imbalance. The two sides recently came to a first-phase agreement on tariffs, though much of the levies remain in place. The trade war, though, continued to take a toll on business investment.

Gross private domestic investment fell 6.1% in the quarter, the third straight decline and significantly worse than the 1% dip in the previous period. Investment in structures slumped 10.1% and equipment, particularly on the industrial side, declined 2.9%. Those decreases were offset somewhat by a 5.9% increase in intellectual property products, the best gain since the first quarter and boosted by software investment. IP theft is a key sticking point in the U.S.-China dispute.

The decline in structures investment came primarily due to mining exploration, shafts and wells. Government spending also contributed to growth during a year in which the U.S. budget saw its first $1 trillion deficit since the early days of the economic recovery from the Great Recession.

Government consumption expenditures and gross investment increased 2.7%, pushed by a 4.9% rise in defense spending. State and local government spending also rose 2.2%. The Congressional Budget Office this week released revised projections that see trillion-dollar fiscal deficits well into the future. The budgetary red ink has fueled a national debt that has now swelled past $23 trillion.

Trump has pressured the Federal Reserve to continue to cut interest rates to help lower debt costs, but the central bank on Wednesday kept its benchmark rate in a range between 1.5%-1.75% and indicated it likely is on hold unless economic conditions change significantly.

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals