Sterling remains firm today and continues to trade as one of the strongest after yesterday’s BoE hold. Yen and Swiss Franc turn mildly softer but stay as two of the strongest too, on risk aversion. Commodity currencies turned mix, digesting this week’s sharp looses. New Zealand Dollar is the weakest for the week, followed by Australian and then Canadian. But there isn’t much difference between them. There is no sign of containment of China’s coronavirus outbreak yet and risk aversion will stay.

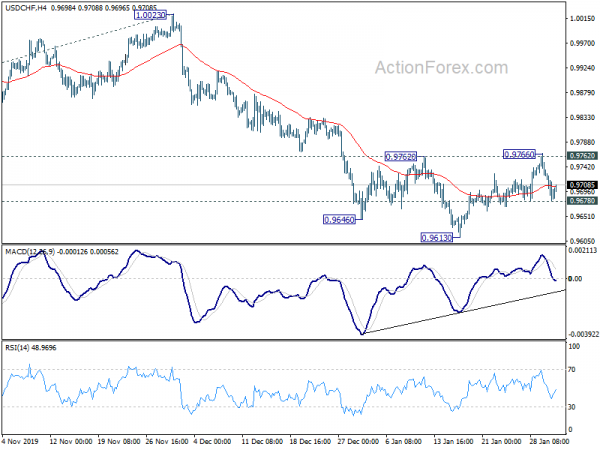

Technically, the forex markets are in consolidative mode today. USD/CHF’s prior rejection by 0.9762 resistance retains near term bearishness. But it’s held above 0.9678 minor support so far. EUR/CHF is also staying in consolidation from 1.0665. GBP/CHF, despite yesterday’s recovery, is stay above 1.2528, below 1.2854 resistance. Traders are holding their bet to wait-and-see the development over the coming weekend.

In Asia, Nikkei is currently up 1.12%. Hong Kong HSI is up 0.32%. Singapore Strait Times is down -0.40%. China remains on holiday. Japan 10-year JGB yield is down -0.0064 at -0.062. Overnight, DOW rose 0.43%. S&P 500 rose 0.31%. NASDAQ rose 0.26%. 10-year yield dropped -0.036 to 1.558.

China’s coronavirus cases hit 9692, death toll at 213

According to latest data from China’s National Health Commission, as of January 31, confirmed cases of coronavirus in the country rose 1982 to 9692. Death toll rose 43 to 213. Serious cases rose from 157 to 1527. Suspected cases rose 3071 to 15238. Number of people tracked rose 24886 to 113579.

WHO has finally declared the coronavirus outbreak a global health emergence. Director-General Tedros Adhanom Ghebreyesus said “the main reason for this declaration is not what is happening in China but what is happening in other countries.” But he added that the organization “doesn’t recommend – and actually opposes” restrictions on travel or trade with China.

Meanwhile, Italian Prime Minister Giuseppe Conte halted all air traffic between Italy and China, after having two confirmed cases in two Chinese tourists. Japan raised travel warning to China to Level 2 and urge its people to avoid unnecessary travel to the country.

Japan industrial production contracted most since 2013 in Q4, despite Dec rebound

Japan industrial production grew 1.3% mom in December, beat expectation of 0.7% mom. However, in the three months of October-December, factory output has indeed contracted -4.0%. That was the worst decline since data began in 2013. The Trade Ministry also said “the pace of rebound (in Dec) was not big… we will closely monitor whether factory output will recover in coming months.” It also kept the assessment of production as weakening.

Retail sales dropped -2.6% yoy in December, down for a third straight month, and missed expectation of -1.8% yoy. Unemployment rate was unchanged at 2.2%, better than expectation of 2.3%. Housing starts dropped -7.9% yoy, versus expectation of -11.5% yoy. Tokyo CPI core slowed to 0.7% yoy in January, down from 0.8% yoy, missed expectation of 0.8% yoy.

Elsewhere

China’s official PMI manufacturing dropped to 50.0 in January, down from 50.2, missed expectation of 50.1. PMI non-manufacturing rose to 54.1, up from 53.5, beat expectation of 53.5. Australia private sector credit rose 0.2% mom in December, matched expectations. PPI rose 0.3% qoq, 1.4% yoy in Q4, matched expectations. UK Gfk consumer confidence improved to -9 in January, matched expectations.

Looking ahead, Eurozone GDP and CPI will be the major focuses in European session. France and Italy will also released GDP. Germany and Swiss will release retail sales. UK will release mortgage approvals and M4 money supply.

Later in the day, US personal income and spending is the major focus, while employment cost index and Chicago PMI will be released. Canada GDP will be featured with IPPI and RMPI.

USD/CHF Daily Outlook

Daily Pivots: (S1) 0.9671; (P) 0.9705; (R1) 0.9729; More…

Intraday bias in USD/CHF remains neutral at this point and outlook remains bearish with 0.9762 resistance intact. On the downside, break of 0.9678 minor support will bring retest of 0.9613 low first. Break will resume larger down trend. On the upside, firm break of 0.9762 will indicate short term bottoming at 0.9613, on bullish convergence condition in 4 hour MACD. Further rise would be seen back towards 1.0023 resistance.

In the bigger picture, medium term outlook remains neutral as USD/CHF is staying sideway trading started from 1.0342 (2016 high). Fall from 1.0237 is a leg inside the pattern and could target 0.9186 (2018 low). In case of another rise, break of 1.0237 is needed to indicate up trend resumption. Otherwise, more sideway trading would be seen with risk of another fall.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 23:30 | JPY | Tokyo CPI Core Y/Y Jan | 0.70% | 0.80% | 0.80% | |

| 23:30 | JPY | Unemployment Rate Dec | 2.20% | 2.30% | 2.20% | |

| 23:50 | JPY | Industrial Production M/M Dec P | 1.30% | 0.70% | -1.00% | |

| 23:50 | JPY | Retail Trade Y/Y Dec | -2.60% | -1.80% | -2.10% | |

| 00:01 | GBP | GfK Consumer Confidence Jan | -9 | -9 | -11 | |

| 00:30 | AUD | Private Sector Credit M/M Dec | 0.20% | 0.20% | 0.10% | 0.20% |

| 00:30 | AUD | PPI Q/Q Q4 | 0.30% | 0.30% | 0.40% | |

| 00:30 | AUD | PPI Y/Y Q4 | 1.40% | 1.40% | 1.60% | |

| 02:00 | CNY | Manufacturing PMI Jan | 50 | 50.1 | 50.2 | |

| 02:00 | CNY | Non-Manufacturing PMI Jan | 54.1 | 53.5 | 53.5 | |

| 05:00 | JPY | Housing Starts Y/Y Dec | -11.50% | -12.70% | ||

| 06:30 | EUR | France GDP Q/Q Q4 P | 0.30% | 0.30% | ||

| 07:00 | EUR | Germany Retail Sales M/M Dec | -0.50% | 2.10% | ||

| 07:30 | CHF | Real Retail Sales Y/Y Dec | 0.40% | 0.00% | ||

| 09:00 | EUR | Italy GDP Q/Q Q4 P | 0.00% | 0.10% | ||

| 09:30 | GBP | Mortgage Approvals Dec | 66K | 65K | ||

| 09:30 | GBP | M4 Money Supply M/M Dec | 0.60% | 0.80% | ||

| 10:00 | EUR | Eurozone GDP Q/Q Q4 P | 0.20% | 0.20% | ||

| 10:00 | EUR | Eurozone CPI Y/Y Jan P | 1.40% | 1.30% | ||

| 10:00 | EUR | Eurozone CPI – Core Y/Y Jan P | 1.20% | 1.30% | ||

| 13:30 | CAD | GDP M/M Nov | 0.10% | -0.10% | ||

| 13:30 | CAD | Raw Material Price Index Dec | 1.50% | |||

| 13:30 | CAD | Industrial Product Price M/M Dec | 0.10% | |||

| 13:30 | USD | Personal Income M/M Dec | 0.30% | 0.50% | ||

| 13:30 | USD | Personal Spending Dec | 0.30% | 0.40% | ||

| 13:30 | USD | PCE Price Index M/M Dec | 0.10% | 0.20% | ||

| 13:30 | USD | PCE Price Index Y/Y Dec | 1.70% | 1.50% | ||

| 13:30 | USD | Core PCE Price Index M/M Dec | 0.20% | 0.10% | ||

| 13:30 | USD | Core PCE Price Index Y/Y Dec | 1.60% | 1.60% | ||

| 13:30 | USD | Employment Cost Index Q4 | 0.70% | 0.70% | ||

| 14:45 | USD | Chicago PMI Jan | 48.7 | 48.9 | ||

| 15:00 | USD | Michigan Consumer Sentiment Jan F | 99.3 | 99.1 |

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals