The U.S. trade deficit fell for the first time in six years in 2019 as the White House’s trade war with China curbed the import bill, keeping the economy on a moderate growth path despite a slowdown in consumer spending and weak business investment.

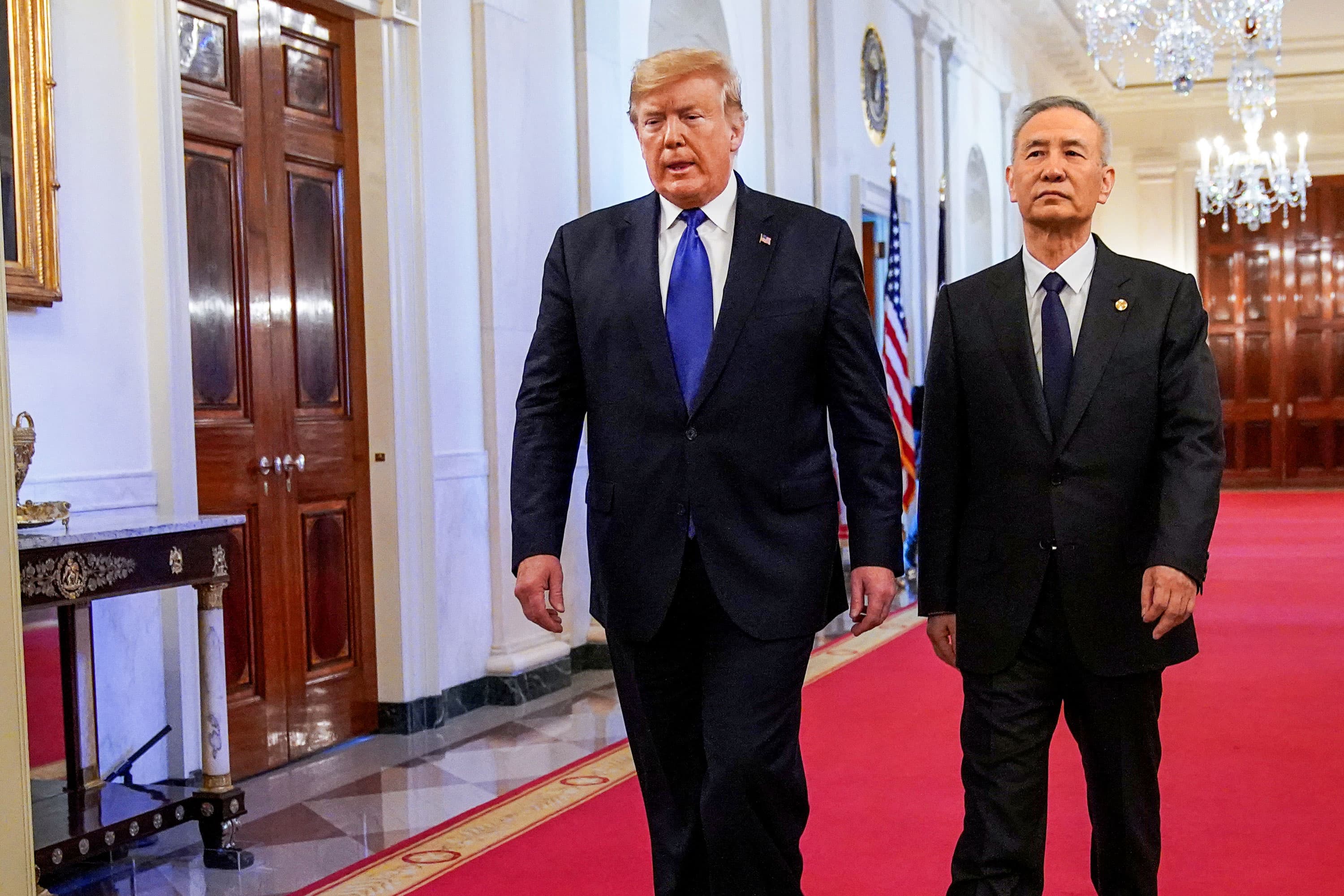

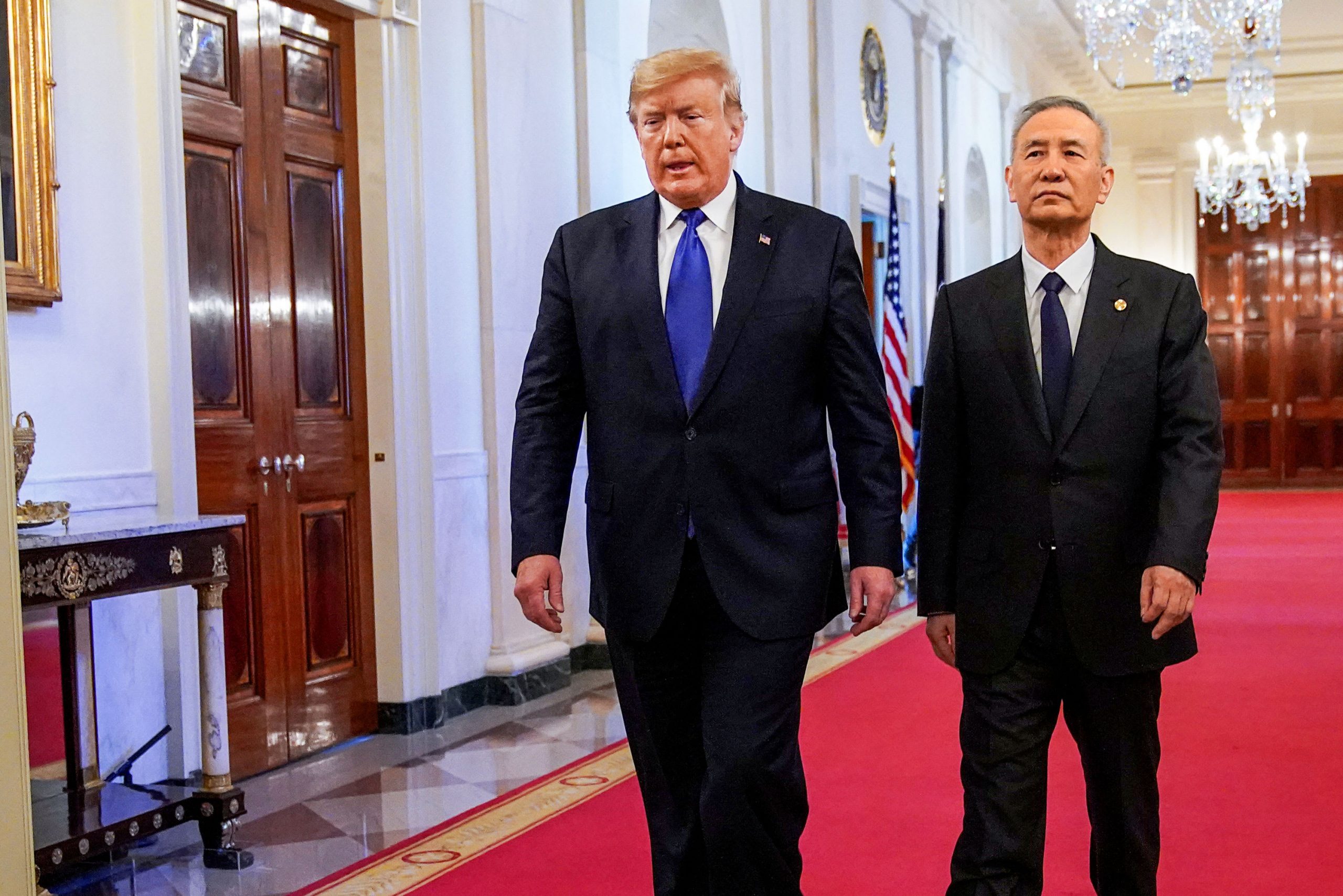

The report from the Commerce Department on Wednesday also showed the Trump administration’s “America First” agenda decreased the flow of goods last year, with exports tumbling for the first time since 2016. President Donald Trump, who has dubbed himself “the tariff man,” has pledged to shrink the deficit by shutting out more unfairly traded imports and renegotiating free trade agreements.

Trump has argued that substantially cutting the trade deficit would boost annual economic growth to 3% on a sustainable basis. The economy has, however, failed to hit that mark, growing 2.3% in 2019, which was the slowest in three years, after expanding 2.9% in 2018.

The trade deficit dropped 1.7% to $616.8 billion last year, declining for the first time since 2013. That represented 2.9% of GDP, down from 3.0% in 2018. Goods imports tumbled 1.7% last year amid steep declines in industrial materials and supplies, consumer goods and other goods. The 1.3% drop in exports was led by decreases in shipments of capital goods, industrial supplies and materials, as well as other goods.

At the height of the U.S.-China trade war last year, Washington slapped tariffs on billions worth of Chinese goods, including consumer products, leading to a decline in imports.

The politically sensitive goods trade deficit with China plunged 17.6% to $345.6 billion in 2019.

The White House has also sparred with other trading partners, including the European Union, Brazil and Argentina, accusing them of devaluing their currencies at the expense of U.S. manufacturers.

The goods trade deficit with Mexico jumped to a record high of $101.8 billion last year. The deficit with the European Union also reached an all-time high of $177.9 billion.

Tensions in the 19-month U.S.-China trade war have eased, with Washington and Beijing signing a Phase 1 trade deal last month. The deal, however, left in place U.S. tariffs on $360 billion of Chinese imports, about two-thirds of the total.

As a result, goods imports rebounded sharply in December, boosting the trade deficit 11.9% to $48.9 billion that month. Data for November was revised to show the gap tightening to $43.7 billion instead of $43.1 billion as previously reported. Economists polled by Reuters had forecast the trade gap would widen to $48.2 billion in December.

U.S. stock index futures were trading higher while prices of U.S. Treasuries were lower. The dollar was slightly stronger against a basket of currencies.

Imports rebound in December

When adjusted for inflation, the goods trade deficit increased $4.3 billion to $80.5 billion in December.

Trade added almost 1.5 percentage points to GDP growth in the fourth quarter, exceeding the 1.20 percentage points contribution from consumer spending, which accounts for more than two-thirds of U.S. economic activity.

The economy grew at a 2.1% annualized rate in the fourth quarter, matching the pace notched in the July-September period.

In December, goods imports surged 3.2% to a seven-month high of $207.5 billion, after declining for three straight months. Goods imports were boosted by a $1.7 billion increase in crude oil imports, which contributed to a $4.0 billion jump in imports of industrial supplies and materials. There was also a $1.2 billion increase in imports of other goods.

Economists believe a 15% tariff on $110 billion worth of Chinese goods that came into effect on Sept. 1 had weighed on imports in the prior months. They also say anticipation that the Phase 1 trade agreement would roll back the tariffs could have encouraged companies to hold off on imports in late 2019.

Goods exports rose 0.9% to $137.7 billion in December. They were lifted by a $1.5 billion jump in shipments of crude oil as well as a $1.0 billion increase in exports of other goods. But motor vehicle and parts exports fell $1.0 billion to $12.4 billion, the lowest since November 2016.

At $17.1 billion, petroleum exports in December were the highest on record.

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals