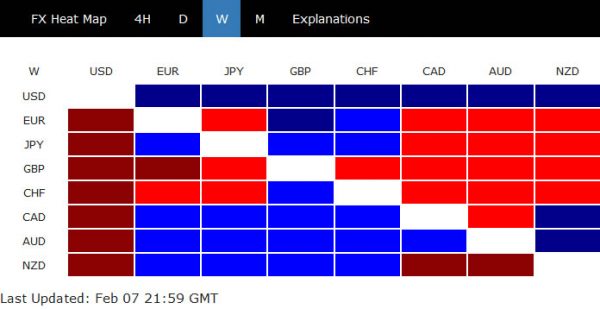

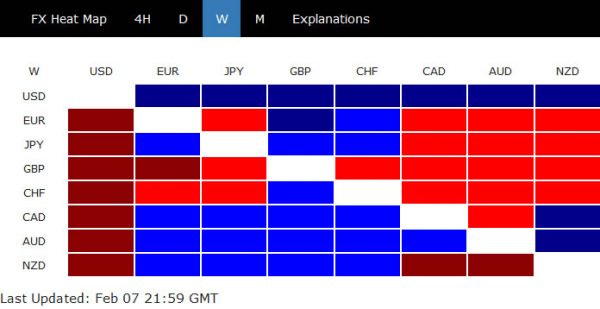

Dollar ended last week as the strongest one as markets put China’s coronavius behind. Instead, strong risk sentiments lifted major US indices to new record highs. Friday’s pull back was likely due to pre-weekend profit taking only. Latest batch of economic data, including ISMs and NFP, suggested that US economy is in healthy shape. The bullish trend should continue for the near term.

Staying in the currency markets, Australian Dollar ended as the second strongest after RBA affirmed its wait-and-see stands. But any renewed weakness in Chinese stocks and extend selloff in commodity could drag the Aussie lower ahead. European majors were the weakest as UK and EU will now enter into negotiations of future relationship. Risk of cliff-edge Brexit by the end of the year remains.

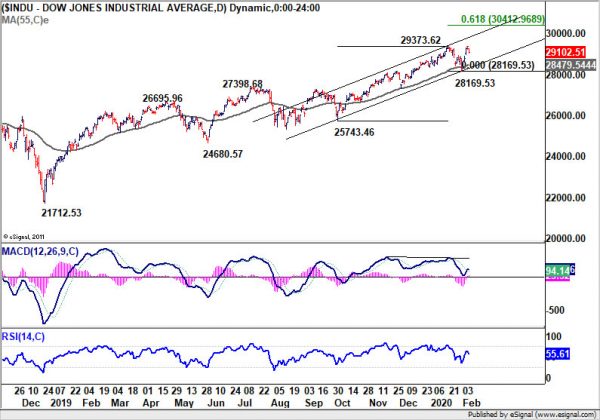

US indices resumed record runs, to continue in near term

Major US indices hit new record highs last week before suffering a rather heavy setback on Friday. To us, the pull back was more about pre-weekend profit taking due to the uncertainty over China’s coronavirus. The outbreak is not expected to have serious contagion effect outside of Asia for the moment, even though risks remain. Hence, for now, we’d continue to expect US stocks to perform well if there is no drastic turn in sentiments.

DOW’s up trend is still in progress and prior strong support from 55 day EMA affirms near term bullishness. On sustained trading above 2937362 resistance, DOW is expected to target 61.8% projection of 25743.46 to 29373.62 from 28169.53 at 30412.96 next.

Chinese stock to stay pressured, poised for another decline

The outlook of Chinese stock market is different though. Shanghai SSE gapped down from holiday and dived to as low as 2685.26. Near term outlook remains decidedly bearish despite the strong rebound to close at 2875.96. Strong resistance should be seen around 29000 handle to finish the rebound and bring fall resumption. Decline from 3288.45 should at least have a take on 100% projection of 3288.45 to 2733.92 from 3127.16 at 2572.63 before completion.

Dollar index to test 99.66 high soon as rally extends

Dollar index’s rise from 96.35 resumed last week and broke 98.54 resistance. The development should confirm completion of whole fall from 99.66 at 96.35. Further rise is now expected as long as 97.35 resistance holds, for 99.66 high. That should correspond to a test of 1.0879 low in EUR/USD.

Fall in iron ore prices might drag down Aussie ahead

Australian Dollar was somewhat supported by the balanced RBA statement last week, but indicates that the central bank is in no rush to cut interest rate again. Yet, the Aussie is facing risk of deterioration of China’s economy, as well as free fall in commodity prices. Iron ore price is back pressing 76.99 support after the sharp decline in the past two weeks.

In the bigger picture, it should have completed a medium term up trend at 115.78 Break of 76.99 will add to the case of trend reversal and target 62.99 support and below. That would give further pressure to the Aussie.

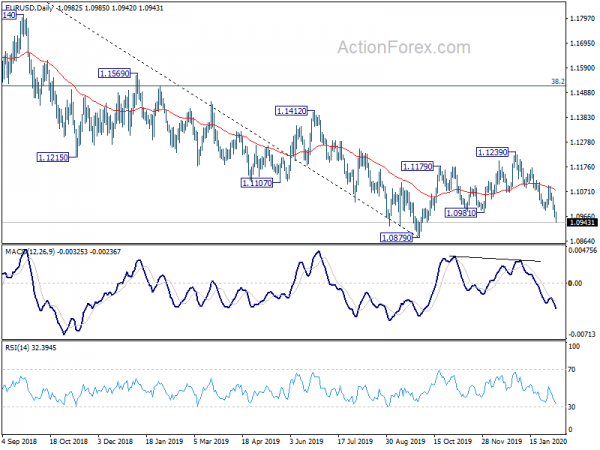

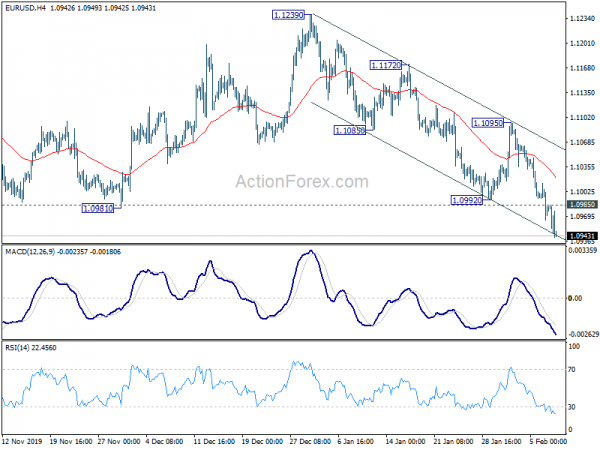

EUR/USD Weekly Outlook

EUR/USD’s decline from 1.1239 resumed last week and reached as low as 1.0942. The strong break of 1.0981 support should confirm the bearish case. That is, corrective rise from 1.0879 has completed with three waves up to 1.1239. Initial bias stays on the downside this week for retesting 1.0879 low. On the upside, above 1.0985 minor resistance will turn intraday bias neutral first. But recovery should be limited below 1.1095 resistance to bring fall resumption.

In the bigger picture, rebound from 1.0879 is seen as a corrective that might have completed after rejection by 55 week EMA. Break of 1.0879 will resume the down trend from 1.2555 (2018 high) for 78.6% retracement of 1.0339 (2017 low) to 1.2555 at 1.0813). Sustained break there will pave the way to retest 1.0339 low. For now, this will remain the favored case as long as 1.1239 resistance holds.

In the long term picture, outlook remains bearish for now. EUR/USD is held below decade long trend line that started from 1.6039 (2008 high). It was also rejected by 38.2% retracement of 1.6039 to 1.0339 at 1.2516 before. A break of 1.0039 low will remain in favor as long as 55 month EMA (now at 1.1516) holds.

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals