Australian Dollar is in free fall in Asian session today as surge in unemployment rate adds to case of April RBA cut. Sentiments are also generally weak as markets disapprove China’s tiny rate cut. Instead, investors are concerned with sign of contagion of Wuhan coronavirus to other Asian countries, in particular Japan and South Korea. Hence, while Yen recovers mildly today, it’s staying as the weakest one for the week. For now, Dollar and Canadian are the strongest.

Technically, AUD/USD finally takes out 0.6670 low decisively and resumes long term down trend. USD/JPY’s break of long term channel resistance is an important sign of medium term bullishness. Further rise should be seen to 112.40 resistance next. EUR/GBP could have formed a short term bottom ahead of 0.8276 low and near term consolidation will likely extend with another rising leg first.

In Asia, currently, Nikkei is up 0.24%. Hong Kong HSI is down -0.81%. China Shanghai SSE is up 0.47%. Singapore Strait Times is down -0.51%. 10-year JGB yield is down -0.0020 at -0.048. Overnight, DOW rose 0.40%. S&P 500 rose 0.47%. NASDAQ rose 0.87%. 10-year yield rose 0.014 to 1.570.

Australia unemployment rate surged to 5.3%, adds to case of April RBA cut

Australia employment grew 13.5k in January, better than expectation of 10.0k. Full time jobs rose 46.2k while part-time jobs dropped -32.7k. But unemployment rate surged to 5.3%, up from 5.1%, worse than expectation of 5.1%. Participation rate rose 0.1% to 66.1%.

The surge in unemployment rate somewhat deviates from RBA’s expectation that it will stay in 5.00-5.25% range for some time before falling to 4.75% in 2021. Also, it has to be considered that the impact of coronavirus outbreak in China hasn’t been reflected there. There is risk of a sudden spike in the data of the coming months. Today’s data adds much weight to the case for RBA to finally deliver another rate cut in April, after much hesitation.

China’s coronavirus cases slowed, but contagion to Asia intensifies

New confirmed cases of Wuhan coronavirus dropped drastically in China. According to the National Health Commission, there were only 394 new cases on February 19, and that’s the lowest level since January 23. Total accumulated number of confirmed cases in China now reached 74576. Death tolls didn’t slow, however, and rose 114 to 2118.

Meanwhile, the outbreak is starting to get serious in surrounding countries. South Korea reported 31 new cases of the Wuhan coronavirus today, with a new outbreak traced to church services in Daegu. Total number of cases in South Korea jumped to 82.

In Japan, more than 620 passengers on the Diamond Princess liner have been infected. NHK said that two from the cruise died, citing an unnamed government source. Outside of the cruise, number of infections in Japan has more than doubled in the past week to 74. Number of cases in Singapore also reached 84. Also, two Iranian citizens, who were tested positive, have died.

As widely expected, China’s PBoC cut its benchmark interest rates today, to counter the economic impact of the Wuhan coronavirus outbreak. One-year loan prime rate was lowered by -10bps to 4.05%. Five-year LPR was lowered by -5 bps to 4.80%. There is no overwhelmingly positive reaction in Hong Kong and China stock markets for now. The tiny step hinted that the Chinese government is just opting for rolling out stimulus as a measured pace.

FOMC minutes said policy appropriate, coronavirus risk warranted watching

In the minutes of January 28-29 FOMC meeting, it’s noted that policymakers generally judged that current monetary stance was “appropriate”. Maintaining current stance, with federal funds rate at 1.50-1.75%, will give the committee ” time for a fuller assessment of the ongoing effects on economic activity of last year’s shift to a more accommodative policy stance”. Fed expected growth to “continue at a moderate pace”.

Trade uncertainties “had diminished recently” and there “signs of stabilization in global growth”. But uncertainties remained, including risks from the outbreak of the coronavirus that started in China. “The threat of the coronavirus, in addition to its human toll, had emerged as a new risk to the global growth outlook, which participants agreed warranted close watching.”

Elsewhere

New Zealand PPI input rose 0.1% qoq in Q4 versus expectation of 0.4% qoq. PPI output rose 0.4% qoq versus expectation of 0.3% qoq. Looking ahead, UK retail sales will be a major focus in European session. ECB meeting accounts will also be closely watched. Germany will release PPI and Gfk consumer sentiment. Swiss will release trade balacne. Later in the day, US will release jobless claims and Philly Fed survey. Canda will release ADP employment and new housing price index.

AUD/USD Daily Report

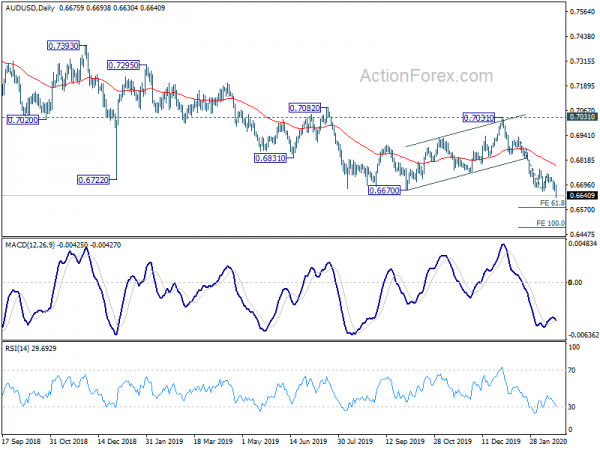

Daily Pivots: (S1) 0.6659; (P) 0.6684; (R1) 0.6702; More….

AUD/USD drops to as low as 0.6630 so far today and the break of 0.6662/70 support zone should confirm long term down trend resumption. Intraday bias is back on the downside. Next near term target will be 61.8% projection of 0.6933 to 0.6662 from 0.6750 at 0.6583, and then 100% projection at 0.6479. On the upside, break of 0.6750 resistance is needed to indicate short term bottoming. Otherwise, outlook will remain bearish in case of recovery.

In the bigger picture, AUD/USD’s decline from 0.8135 (2018 high) is still in progress. It’s part of the larger down trend from 1.1079 (2011 high). Rejection by 55 week EMA affirms medium term bearishness. Next target is 0.6008 (2008 low). Outlook will stay bearish as long as 0.7031 resistance holds, even in case of strong rebound.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 21:45 | NZD | PPI – Input Q/Q Q4 | 0.10% | 0.40% | 0.90% | |

| 21:45 | NZD | PPI – Output Q/Q Q4 | 0.40% | 0.30% | 1.00% | |

| 0:30 | AUD | Employment Change Jan | 13.5K | 10.0K | 28.9K | |

| 0:30 | AUD | Unemployment Rate Jan | 5.30% | 5.20% | 5.10% | |

| 7:00 | CHF | Trade Balance (CHF) Jan | 2.54B | 1.96B | ||

| 7:00 | EUR | Germany Gfk Consumer Confidence Mar | 9.8 | 9.9 | ||

| 7:00 | EUR | Germany PPI M/M Jan | 0.20% | 0.10% | ||

| 7:00 | EUR | Germany PPI Y/Y Jan | -0.20% | -0.20% | ||

| 9:30 | GBP | Retail Sales M/M Jan | 0.40% | -0.60% | ||

| 9:30 | GBP | Retail Sales Y/Y Jan | 0.40% | 0.90% | ||

| 9:30 | GBP | Retail Sales ex-Fuel M/M Jan | 0.60% | -0.80% | ||

| 9:30 | GBP | Retail Sales ex-Fuel Y/Y Jan | 0.70% | 0.70% | ||

| 11:00 | GBP | CBI Industrial Trends Orders M/M Feb | -19 | -22 | ||

| 12:30 | EUR | ECB Monetary Policy Meeting Accounts | ||||

| 13:30 | USD | Initial Jobless Claims (Feb 14) | 210K | 205K | ||

| 13:30 | CAD | ADP Employment Change Jan | 46.2K | |||

| 13:30 | CAD | New Housing Price Index M/M Jan | 0.20% | |||

| 13:30 | USD | Philadelphia Fed Manufacturing Survey Feb | 12 | 17 | ||

| 15:00 | EUR | Eurozone Consumer Confidence Feb P | -8 | -8 | ||

| 15:30 | USD | Natural Gas Storage | -115B |

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals