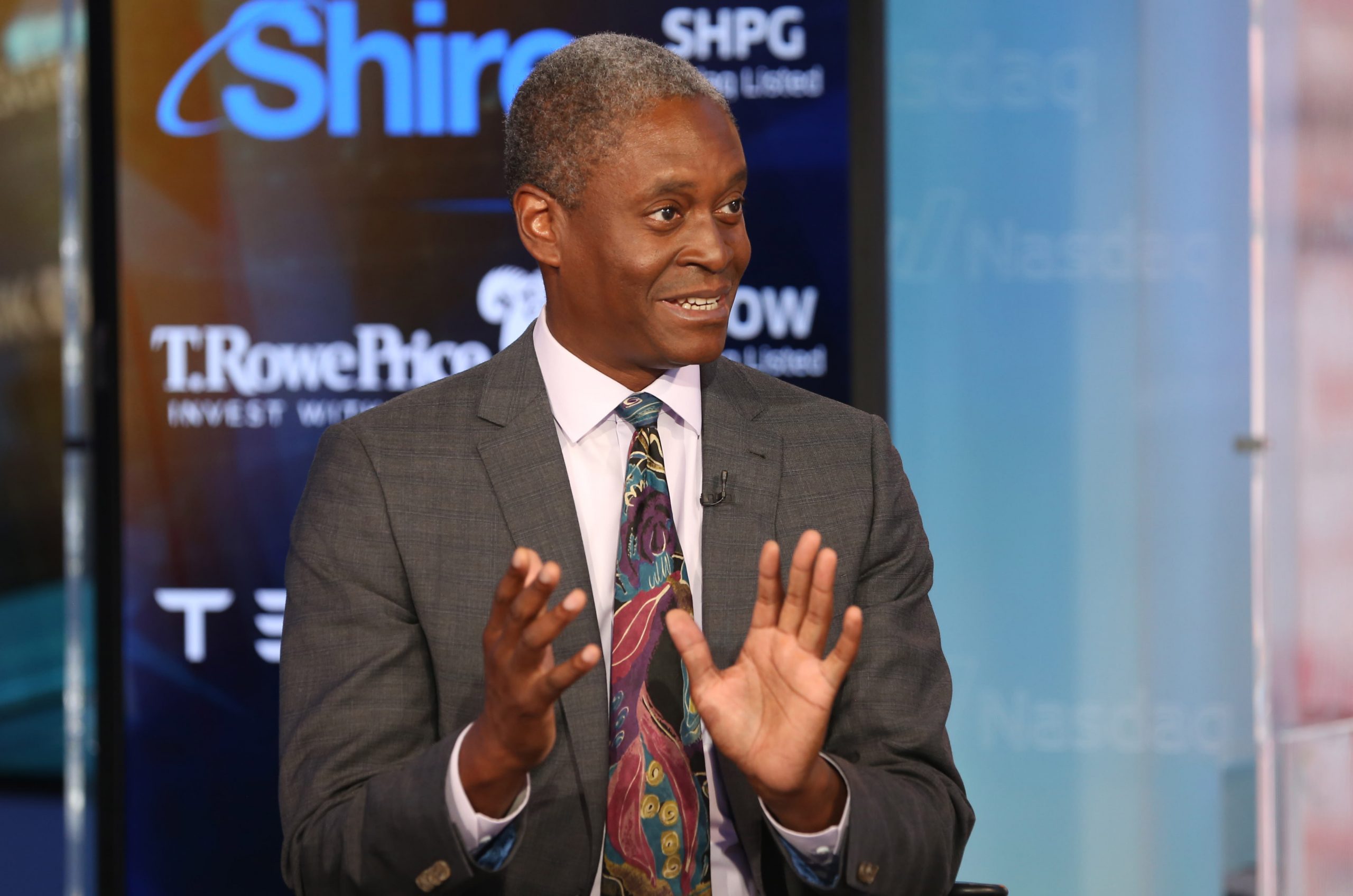

Atlanta Federal Reserve President Raphael Bostic became the latest central banker to advocate a hold on interest rates, telling CNBC that he doesn’t see a need to change given current conditions.

Despite the market pricing in up to two cuts this year, Bostic said that unless there’s a significant shift in economic performance, the Fed should stay put.

“There are many different scenarios about what’s going to happen between now and say June or July. My baseline expectations are that the economy is not going to see rising risks and it’s going to stay stable, so we won’t have to do anything,” he told CNBC’s Steve Liesman during a “Squawk Box” interview.

“But my focus is on today and what we know today and what we know next week as the data comes in. If we see more weakness than expected, then I’d be open to moving. But that’s not my expectation,” he added.

Bullard, Clarida also see no cuts

Though he is not a voter this year on the Federal Open Market Committee, Bostic gets input into the decision-making process.

Earlier Friday, St. Louis Fed President James Bullard also told CNBC he does not see a likelihood of a cut, and both speakers come a day after Fed Vice Chairman Richard Clarida also told the network that he’s not anticipating a change.

Markets, though, are not on the same page.

Traders in the fund funds futures market are indicating a 54% chance of a rate cut by June and a 59% probability of two moves by the end of the year, despite consistent statements from Fed officials indicating otherwise. Markets fear that the coronavirus could continue to spread and dent global economic growth, necessitating a further easing on policy beyond the three cuts the Fed implemented in 2019.

Like Bullard, Bostic said he expects the coronavirus to be “a short-term hit” to the economy.

“I have no impulses really to think that we need to do anything differently with our policy stance than we are doing today,” Bostic said.

The Fed currently targets its benchmark overnight borrowing rate in a range between 1.5%-1.75%. The FOMC has kept the rate steady the past two meetings after last year’s cuts.

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals