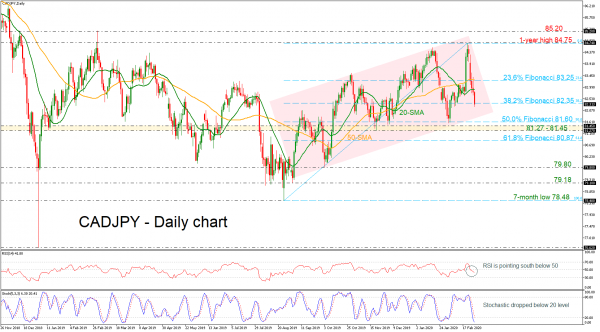

CADJPY has been in the red over the last four days, but it is still trading within an upward sloping channel, which has been holding since September 2019. The latest drop started after the pair found a wall at the one-year high of 84.75.

According to the RSI, the market could push for further losses in the short-term as the indicator strengthens its negative momentum below its 50 level. The stochastic is also falling, though, it is relatively close to the 20 oversold threshold and a bullish correction may come.

In the negative scenario, where the price continues to plunge below the 38.2% Fibonacci retracement level of the upward wave from 78.48 to 84.75 at 82.35, a new bottom could be formed around the lower boundary of the channel and the 50.0% Fibonacci of 81.60. If the market manages to overcome that area, traders could wait for another downside extension towards the 81.27 – 81.45 support area.

An upside reversal could open the door for the 20-day simple moving average (SMA) currently at 82.90 before the spotlight turns to the 23.6% Fibo of 83.25, which overlaps with the 40-day SMA. Above that, the one-year peak of 84.75 could come next into focus.

In brief, the short-term bias is bearish, whereas the medium-term outlook remains positive.

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals