U.S. Highlights

- Fears about the widening spread of Covid-19 lead to the worst week for equity markets since 2008. The 10-Year Treasury yield continued to find new all-time lows on Friday, and the Brent price of oil was down 15% on the week midday Friday.

- News on outbreaks in Italy and Iran several days ago confirmed that the spread is not likely to be contained to China and its closest neighbors. As containment efforts and fears increase, the hit to the global economy worsens.

- Fed speakers pointed out that rate cuts are a possibility if a global pandemic develops. But, the U.S. is still being affected by the stimulus from last year’s rate cuts, which will help it navigate the current situation of uncertainty.

Canadian Highlights

- Canada joined the selloffs in global financial markets this week, with the S&P/TSX plunging by roughly 10% relative to a week ago (as of writing).

- Covid-19 adds to the headwinds already blowing against the Canadian economy, which came to a virtual standstill at year end. Real GDP eked out a 0.3% (annualized) gain in Q4, held back by a decline in exports and investment.

- Market implied odds of the Bank of Canada rate cut in March have risen considerably. A rate cut next Wednesday seems unlikely (though not impossible), but we expect Governor Poloz to use this opportunity to open the door even wider to monetary easing later this Spring.

U.S. – Pandemic Panic

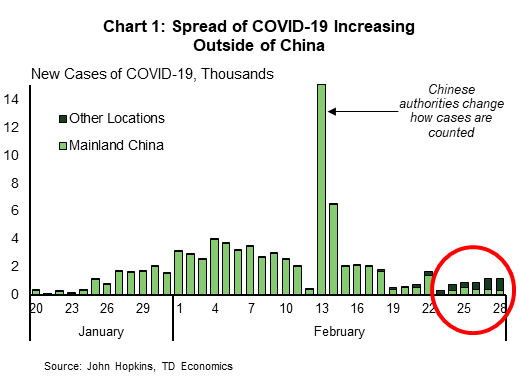

It has been a horrible week for financial markets as fears of coronavirus spread. Bond and commodity markets had been factoring in greater economic weakness for a few weeks already, but the yield on the 10-Year Treasury continued to plumb new lows on Friday, and oil prices are down around 15% on the week at time of writing. Equity markets had remained defiantly optimistic until news of larger outbreaks in Italy and Iran showed that the spread is not likely to be contained to China and its closest neighbors (Chart 1). Equity investors were further rattled by companies warning that the virus would impact earnings this quarter. All told, global stock markets entered correction territory in what is shaping up to be the worst week for the S&P 500 since the fall of 2008 (Chart 2).

Adding to market fears, the Center for Disease Control warned Americans to prepare for containment measures and community spread of the virus. Even if quarantines do not become widespread in the United States, fear will likely lead consumers to spend less, weighing on economic activity.

Globally, containment measures will hold back economic activity. In Japan, schools have been urged to close until April 8th, and Prime Minister Abe also called for cancellation of large-scale public events and sports matches. Switzerland has banned large gatherings, and various conferences are being cancelled as businesses shy away from non-essential travel. All told, our upcoming quarterly forecast will feature a downgrade to global economic growth.

As the economic hit worsens, governments have started to announce spending packages designed to help cushion the blow. Hong Kong has announced the largest fiscal stimulus so far, amounting to 4.2% of GDP. That includes $1,280 of one-time cash to all permanent residents. In Hong Kong’s case, the stimulus comes after months of protests had already pushed the economy into recession.

South Korea, which is the hardest-hit country outside of China, plans to spend more than $13 bn to combat the economic impact of the virus (about 0.8% of GDP), with potentially more money to come. Malaysia and Singapore have also announced stimulus packages of 1.3% and 1.1% of GDP respectively.

Back stateside, all eyes will be on the ISM indexes for February released next week, for early signs on how business sentiment held up in the face of early news on Covid-19. We expect some weakness in both manufacturing and services sentiment, and we may also get some sense how factories are dealing with disruptions to their Asian supply chains. There is unlikely to be much impact on Friday’s job numbers for February, although you could see some weakness in leisure and hospitality hiring as tourism takes a hit.

The Fed’s Bullard said on Friday that further rate cuts are a possibility if a global pandemic actually develops, but this is not the Fed’s base case. He also pointed out that the stimulus from last year’s rate cuts are still aiding the economy, and this will help it navigate the current uncertain situation.

Canada – Rate Cut Odds Surge As Covid-19 Spreads

Fear gripped financial markets this week as Covid-19 continued to spread globally. Even as the virus threat appeared to be receding in China, the number of new cases outside of the country continued to mount this week, surpassing those in China itself. This dimmed hopes of quick virus containment, raising investors’ anxiety about the fallout from the outbreak on already-soft global growth.

Reflective of investors’ worries, bonds rallied while equities sold-off precipitously. U.S. markets entered correction territory and the S&P/TSX followed suit. Trading was halted early on Thursday due to a technical issue, but the sell-off caught up on Friday. At the time of writing, the S&P/TSX was down by roughly 10% from the last Friday, erasing all the gains since last August. Meanwhile, crude oil prices plummeted to the lowest level since July 2017, taking the Canadian dollar down with it.

Even prior to the Covid-19 outbreak, the Canadian economy experienced no shortage of headwinds, prompting expectations of a lackluster economic performance in the fourth quarter and weak momentum heading into 2020. Those expectations were largely borne out by the economic data released this week. Echoing the weakness in retail sales, wholesale trade similarly ended the year on weak footing, with trade volumes declining 1.8% in the quarter, marking the weakest performance outside of a recession.

Given the already-low growth bar set for the quarter, there were few surprises in this morning’s GDP release. The economy came to a virtual standstill at the year-end as real GDP eked out a 0.3% (annualized) gain, meeting our and the Bank of Canada’s modest expectations. Growth was held back by a decline in exports and investment. The one piece of good news was consumer spending, which grew by 2.0% in the quarter, led by a 3.4% rise in spending on services.

Meanwhile, business confidence and investment both took it on the chin in 2019, and, according to this week’s release of Statistics Canada’s annual capital spending survey, a meaningful rebound in investment is unlikely this year. Based on responses collected prior to Covid-19 outbreak, nominal capital spending was expected to grow by just 2.8% this year. Excluding public sector spending, private sector plans were projected to increase by just 0.9% – the weakest intentions outside of the global financial crisis and 2015-2016 energy price adjustment period.

From the Bank of Canada’s perspective soft growth at the end of 2019 is old news, though it does give important context to its interest rate decision next week. Still, developments since then are likely to take up much of the discussion. Like everyone else the Bank will be asking the questions: how long will the coronavirus disruption last, and how deep will the disruption be? While the odds of the rate cut in March have risen considerably (Chart 2), it may be too early to expect the Bank to have all the answers, so a rate cut next Wednesday seems unlikely (though not impossible). Instead, given the list of risks facing the Canadian economy, we expect Governor Poloz to use this opportunity to open the door even wider to monetary easing later this Spring.

U.S: Upcoming Key Economic Releases

U.S. ISM Manufacturing/Non-manufacturing Index – February

Release Date: March 2, 4, 2020

Previous: Spending: 50.9/55.5

TD Forecast: Spending: 50.5/54.5

Consensus: Spending: 50.5/55.0

Markit’s manufacturing PMI fell 0.9 points in the flash report for February, but the regional surveys were mixed, resulting in no clear signal for the manufacturing ISM index. We forecast a modest decline to 50.5, consistent with the manufacturing sector remaining weak but not suddenly collapsing. Most of the responses to the February survey were likely submitted before last week’s plunge in equities. On the other hand, the non-manufacturing ISM index is unlikely to be as weak as the manufacturing index, or the Markit services PMI (49.4), but we expect some slippage, due in part to COVID-19 worries. We forecast a 1pt decline to 54.5.

U.S. Employment – February

Release Date: March 6, 2020

Previous: 225k, unemployment rate 3.6%

TD Forecast: 170k, unemployment rate 3.6%

Consensus: 175k, unemployment rate 3.5%

Payrolls probably slowed significantly after a mild-weather-assisted surge in January; the 225K rise was above last year’s 175K average, even though the trend is probably slowing. The weather was milder than usual in February as well, but not to the same degree as in January. Our 170K forecast allows for a 7K boost from temporary hiring for the 2020 census, consistent with weekly data released by the Census Bureau. As a result, the private payrolls reading will be much more important than the total number for gauging the underlying trend until around September. Average hourly earnings probably rose strongly on a month-over-month basis, helped by calendar effects. We expect the 12-month change to hold at 3.1%.

Canada: Upcoming Key Economic Releases

Bank of Canada Rate Decision

Release Date: March 4, 2020

Previous: 1.75%

TD Forecast: 1.75%

Consensus: 1.75%

There is considerable uncertainty surrounding next week’s Bank of Canada meeting, but we think the Bank will ultimately leave rates unchanged at 1.75% as they await more information on the economic implications of COVID-19. While recent data has been downbeat, it has not underperformed BoC projections and the Bank is still navigating a precarious course, balancing near-term support for the economy against longer-term risks to financial stability. While markets are pricing in a >50% chance of a cut, Governor Poloz has proven willing to look past market pricing in the past, and we think waiting until April is more consistent with the Bank’s data dependent approach.

Canadian Employment- February

Release Date: March 4th, 2020

Previous: 35k, unemployment rate: 5.5%

TD Forecast: 12k, unemployment rate: 5.6%

Consensus: NA

TD looks for the labour market to add 12k jobs in February following two months of >25k job growth. This recent strength has pushed the 6m trend above 20k for the first time since September, which while positive, strikes us as unsustainable given overall labour market tightness and signs of fatigue in other parts of the economy. Small business hiring intentions are sitting at the second-lowest level since 2016, and industry-level GDP growth has averaged less than 0.1% over the last six months. Following last month’s surge in goods-producing employment, we look for services to drive overall job growth, led by a rebound in health care. Transportation employment should not be impacted by the VIA Rail layoffs as these occurred after the reference week, although this will be a risk for March should rail blockades continue over the next month. Elsewhere, modest job growth figures should see the unemployment rate edge higher to 5.6% (from 5.54%) while we see wage growth cooling to 3.9% owing to a combination of base-effects and some moderation from the 1.0% m/m increase in January.

Canadian International Merchandise Trade-January

Release Date: March 6th, 2020

Previous: -$0.37bn

TD Forecast: -$0.90 bn

Consensus: NA

The international trade balance is projected to deteriorate to a $900m deficit in January (from -$370m) owing to a combination of softer export activity and a more modest decline for imports. Energy exports will provide the key driver towards the former, with a significant drag from lower oil prices and PADD II imports, while autos are also expected to make a negative contribution following the final winddown of GM’s Oshawa plant. Meanwhile, imports will be weighed down by softer industrial production south of the border and sluggish domestic demand.

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals