While Fed’s QE infinity gave no apparent boost to US stocks, Asian markets are responding rather positively. Strong gains are seen in major indices. Dollar has turned broadly weak, followed by Swiss Franc, Yen and Euro. Australian Dollar is leading commodity currencies higher. Gold also ride on greenback’s pull back too.

Technically, current decline in Dollar is seen as nothing more than part of near term consolidations. New highs against other major currencies are expected at a later stage. We’d maintain this view at least before a break of 1.0981 minor resistance in EUR/USD, 1.2129 minor resistance in GBP/USD and 0.9649 minor support in USD/CHF.

In Asia, Nikkei closed up 1204.57 pts or 7.13%. Hong Kong HSI is up 4.06%. China Shanghai SSE is up 2.15%. Singapore Strait Times is up 3.96%. Japan 10-year JGB yield is down -0.0260 at 0.043. Overnight, DOWN dropped -3.04%. S&P 500 dropped -2.93%. NASDAQ dropped -0.27% only. 10-year yield dropped -0.174 to 0.764.

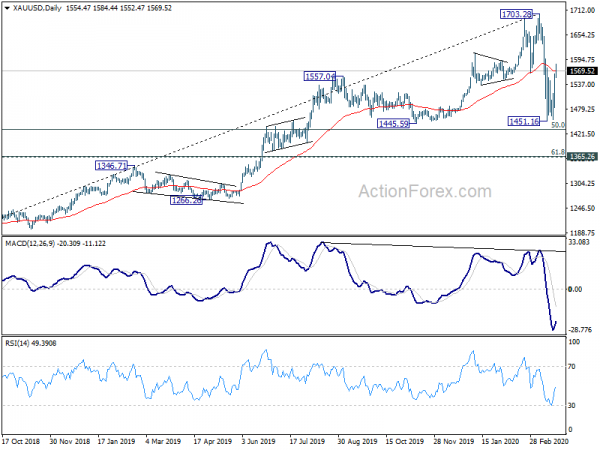

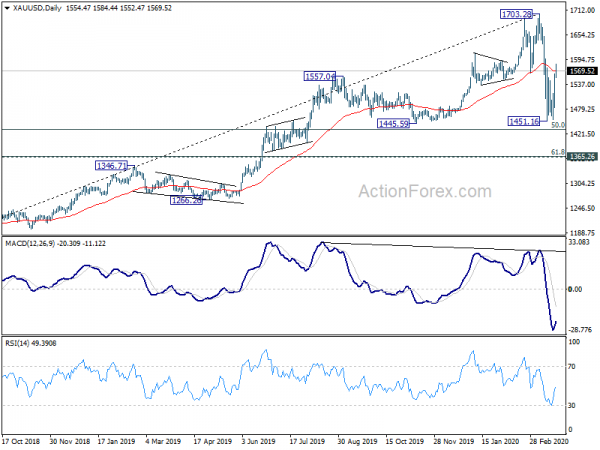

Gold in second leg of medium term consolidation with current rebound

Gold’s break of 55 day EMA now suggests that fall from 1703.28 has completed at 1451.16. Notable support was seen from 55 week EMA and above 1445.59 structural level. Nevertheless, such decline is just seen as the third leg of a medium term corrective pattern, to the whole rise from 1160.17. Therefore, while further rebound could be seen, upside should be limited by 1703.28 high. Another falling leg is expected at a later stage, to complete a three-wave corrective pattern.

The eventual depth of the correction would very much depend on the strength of the current second leg rebound. We’d keep open the case for a take of 1365.26 cluster support (61.8% retracement of 1160.17 to 1703.28 at 1367.63) before completing the correction.

Japan PMI composite dropped to 35.8, aggressive downturn led primarily by service

Japan PMI Manufacturing dropped to 44.8 in March, down fro 47.8. That’s the lowest level since April 2019. PMI Services dropped sharply to 32.7, down from 46.8. That’s the lowest level since the start of the survey in September 2007. PMI Composite dropped to 35.8, down from 47.0, lowest since April 2011.

Joe Hayes, Economist at IHS Markit said: ” Latest PMI data show that the Japanese economy slipped into an aggressive downturn in March that was primarily led by the service sector… In contrast to other parts of Asia, the US and Europe, Japan (at the time of writing) has not issued a public lockdown, while there are reports that footfall in places such as Tokyo remains high. If the outbreak were to accelerate, the economic damage could far exceed what we’ve seen so far, particularly if The Olympic Games are postponed”.

Suggested reading: Flash PMI Gives More Evidence that Japan has Entered Recession, Unlikely to be Rescued by Stimulus

Japan to strengthen monitoring of fraudulent market activities

Japan Finance Minister Taro Aso warned that the Financial Services Agency will strengthen monitoring against improper trading activity at the current time of heightened market volatility. In particular, the FSA will with with securities watchdog and stock exchanges to monitor fraudulent activities in market operations.

He also made a rare comment regarding Dollar’s strength. Aso said, “Everyone is buying dollars. That’s leading to declines in other currencies. Stocks and bond prices are both falling, which is something that has not happened before.” “It’s probably investors’ anxiety” over the coronavirus pandemic, he added.

Australia CBA PMI composite dropped to 40.7, increasing impact of coronavirus

Australia CBA PMI Manufacturing was very steady in March, just dropped -0.1 to 50.1. PMI Services, however, tumbled sharply from 49.0 to 39.8. Hence, PMI Composite dropped from 49.0 to 40.7.

CBA Chief Economist, Michael Blythe said: “The sharp deterioration in PMI readings during March underline the increasing impact of the coronavirus on the Australian economy. The services sector is being hit hard by the cancellation of events, general fears about social interaction and a very sharp decline in offshore demand as travel restrictions bite.

“The manufacturing sector is faring a little better. But the leading indicators are flashing warning signs. The deterioration in supplier delivery times is accelerating, highlighting the disruption to supply chains. And the lower Aussie dollar is pushing input prices up at a rapid rate”.

Suggested reading on Australian economy: Australian Unemployment Rate Set to Reach 11% by June

Looking ahead

PMIs from Eurozone, UK and US will be the major focuses today, showing how deep the impact of coronavirus pandemic is. UK will also release CBI industrial orders expectations. US will release new home sales.

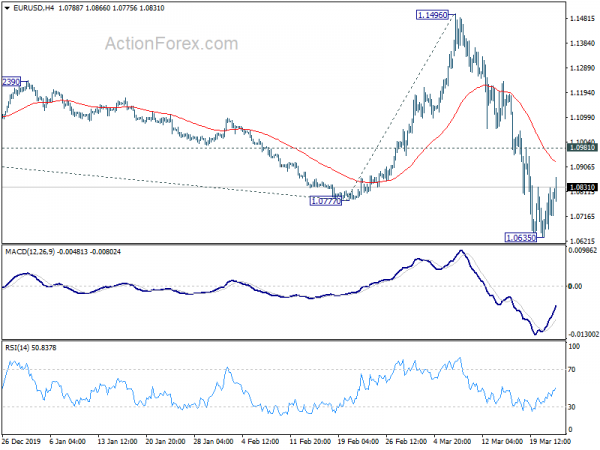

EUR/USD Daily Outlook

Daily Pivots: (S1) 1.0632; (P) 1.0730; (R1) 1.0824; More…

EUR/USD recovers mildly as consolidation from 1.0635 temporary low extends. Further rise cannot be ruled out but upside should be limited by 1.0981 resistance to bring fall resumption. On the downside, break of 1.0635 will extend larger down trend for 1.0397 projection target next. However, sustained break of 1.0981 will indicate stronger rebound is underway back towards 1.1496 key resistance.

In the bigger picture, whole down trend form 1.2555 (2018 high) should have resumed. Next target is 61.8% projection of 1.2555 to 1.0777 from 1.1496 at 1.0397. This level is close to 1.0339 (2017 low). On the upside, break of 1.1496 resistance is needed to indicate medium term reversal. Otherwise, outlook will remain bearish even in case of strong rebound.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 22:00 | AUD | CBA Manufacturing PMI Mar P | 50.1 | 50.2 | ||

| 22:00 | AUD | CBA Services PMI Mar P | 39.8 | 49 | ||

| 00:30 | JPY | Manufacturing PMI Mar P | 44.8 | 42.1 | 47.8 | |

| 08:15 | EUR | France Manufacturing PMI Mar P | 39.4 | 49.8 | ||

| 08:15 | EUR | France Services PMI Mar P | 39.6 | 52.5 | ||

| 08:30 | EUR | Germany Manufacturing PMI Mar P | 40.1 | 48 | ||

| 08:30 | EUR | Germany Services PMI Mar P | 43 | 52.5 | ||

| 09:00 | EUR | Eurozone Manufacturing PMI Mar P | 40.1 | 49.2 | ||

| 09:00 | EUR | Eurozone Services PMI Mar P | 40 | 52.6 | ||

| 09:30 | GBP | Manufacturing PMI Mar P | 45.1 | 51.7 | ||

| 09:30 | GBP | Services PMI Mar P | 45 | 53.2 | ||

| 11:00 | GBP | CBI Industrial Order Expectations Mar | -38 | -18 | ||

| 13:45 | USD | Manufacturing PMI Mar P | 45.1 | 50.7 | ||

| 13:45 | USD | Services PMI Mar P | 44.1 | 49.4 | ||

| 14:00 | USD | New Home Sales M/M Feb | 750K | 764K |

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals