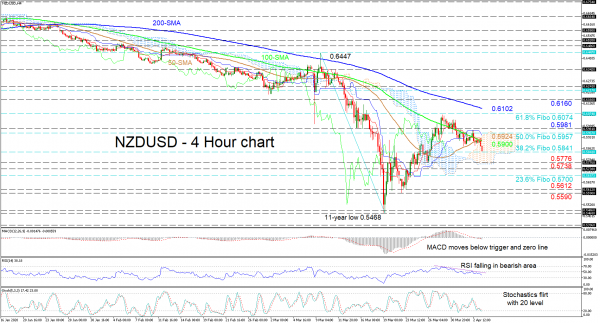

NZDUSD is presently tackling the 0.5841 level, that being the 38.2% Fibonacci retracement of the down leg from 0.6447 to an 11-year low of 0.5468, after new found negative sentiment sent the pair back down into the Ichimoku cloud. Aiding this move down is the recent bearish crossover of the now declining Ichimoku lines.

The short-term oscillators are providing extra backing towards a negative picture. The MACD has slipped below its zero and trigger lines, while the RSI is falling in the bearish zone. Moreover, the stochastic lines are shifting slowly into oversold territory. That said, if buying interest picks up traders need to be careful of the recent bullish overlap of the 100-period simple moving average (SMA) by the 50-period one.

If sellers manage to guide the pair past the 38.2% Fibo of 0.5841 and down into the cloud, initial hindrance could come from the 0.5776 obstacle and the lower band of the cloud, marginally beneath. Falling further, if the bears dive below the 0.5738 swing low and the 23.6% Fibo of 0.5700, their efforts to return to 11-year low levels could be challenged by the 0.5612 – 0.5590 area of troughs.

Alternatively, if buyers resurface and push above the 100- and 50-period SMAs at 0.5900 and 0.5924 respectively, initial resistance could come from the 50.0% Fibo of 0.5957 and the nearby high of 0.5981. Maintaining confidence to drive the price above the 61.8% Fibo of 0.6074 could see the 200-period SMA at 0.6102 come under pressure ahead of the 0.6160 barrier.

Summarizing, the near-term bias looks to be realigning with the short-term negative outlook and a close below 0.5738 could strengthen that view.

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals