Key Highlights

- USD/JPY is struggling to gain traction above the 109.40 resistance.

- The pair could extend its decline if it breaks the 108.00 support.

- The US Initial Jobless Claims for the week ending April 04, 2020 declined from 6867K to 6606K.

- The US Consumer Price Index is likely to drop 0.3% in March 2020 (MoM).

USD/JPY Technical Analysis

After testing the 107.00 support area, the US Dollar climbed back above the 108.00 pivot level against the Japanese Yen. However, USD/JPY is struggling to gain traction above the 109.40 resistance.

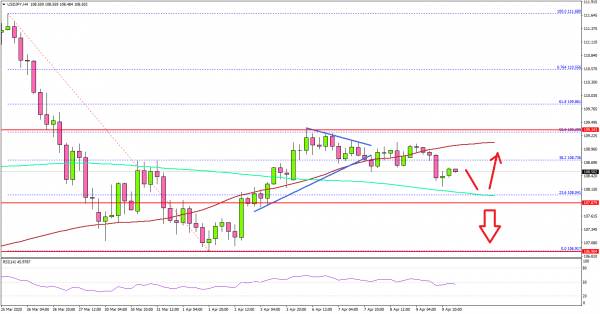

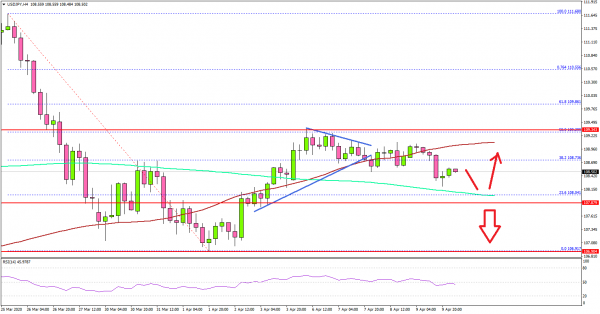

Looking at the 4-hours chart, the pair recently tested the 109.40 resistance area and the 50% Fib retracement level of the key decline from the 111.68 high to 106.91 low.

The bulls struggled to push the pair above 109.40 resulting in a bearish reaction below the 100 simple moving average (red, 4-hours). Besides, there was a break below a short term contracting triangle with support at 108.75.

On the downside, there is a key support forming near the 108.00 level and 200 simple moving average (green, 4-hours). If the pair fails to stay above 108.00, it could extend its decline towards the 107.00 and 106.50 support levels.

Conversely, a successful break above the 109.40 resistance level might set the pace for a sharp rise in the coming sessions towards 110.00 and 111.00.

Fundamentally, the US Initial Jobless Claims figure for the week ending April 04, 2020 was released by the US Department of Labor. The market was looking for a decline from the last reading of 6648K to 5252K.

The actual result was disappointing, as the US Initial Jobless Claims came in at 6606K. Besides, the last reading was revised up from 6648K to 6867K.

The report added:

The 4-week moving average was 4,265,500, an increase of 1,598,750 from the previous week’s revised average. The previous week’s average was revised up by 54,750 from 2,612,000 to 2,666,750.

Overall, USD/JPY remains at a risk of more losses if it breaks the 108.00 support. Conversely, both EUR/USD and GBP/USD are showing positive signs above 1.0850 and 1.2400 respectively.

Upcoming Economic Releases

- US Consumer Price Index March 2020 (MoM) – Forecast -0.3%, versus +0.1% previous.

- US Consumer Price Index March 2020 (YoY) – Forecast +1.6%, versus +2.3% previous.

- US Consumer Price Index Ex Food & Energy March 2020 (YoY) – Forecast +2.3%, versus +2.4% previous.

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals