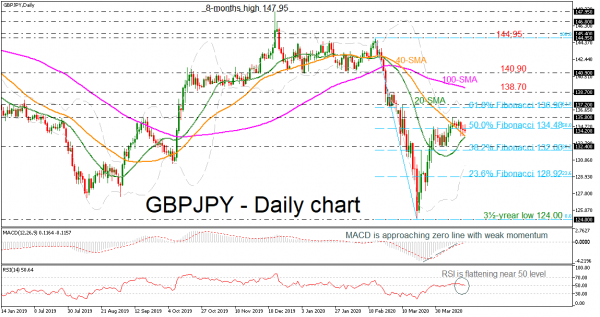

GBPJPY is turning slightly lower over the last few days touching the 40-day simple moving average (SMA) and the 50.0% Fibonacci retracement level of the down leg from 144.95 to 124.00 at 134.48.

Technically, the RSI indicator is challenging the neutral threshold of 50, while the MACD entered the positive territory but it travels with weak momentum.

The 40-day SMA may act as strong support for the pair and send the market higher again towards the 135.80 high. A jump above the latest high could see the 61.8% Fibonacci mark of 136.90, which stands near the 137.20 resistance level. Even higher, the 138.70 barrier could be a strong barrier for the bulls ahead of the 100-day SMA currently at 139.15.

However, if the price falls underneath the possible upside bullish cross within the short-term SMAs, it may flirt with the 132.40 support and the 38.2% Fibonacci of 132.00. A drop below this line could increase sentiment for bearish structure again towards the 23.6% Fibonacci of 128.92 before visiting the three-and-a-half year low of 124.00.

Overall, GBPUSD could extend the positive retracement in the short-term, while in the medium-term the price is still strongly negative.

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals