Key Highlights

- EUR/USD failed to break 1.1000 and declined below 1.0900.

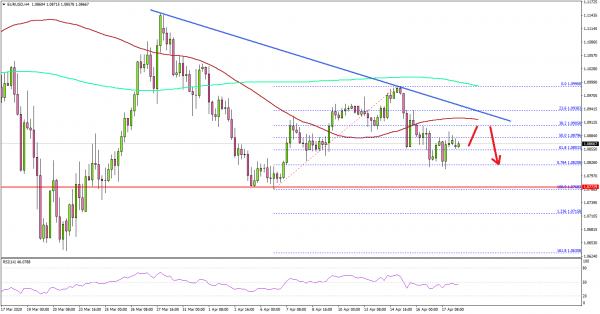

- A crucial resistance is forming with resistance near 1.0950.

- There is also a key bearish trend line in place with resistance near 1.0930 on the 4-hours chart.

- The Euro Zone CPI increased 0.7% in March 2020 (YoY), similar to the forecast.

EUR/USD Technical Analysis

This past week, the Euro made an attempt to surpass the 1.1000 resistance against the US Dollar, but it failed. As a result, EUR/USD started a fresh decline below the 1.0950 support area.

Looking at the 4-hours chart, the pair remained well below the 200 simple moving average (green, 4-hours) and declined below many key supports near 1.0950.

The pair traded below the 50% Fib retracement level of the main upward move from the 1.0768 low to 1.0990 high. Besides, there was a break below the 1.0900 level and the 100 simple moving average (red, 4-hours).

An initial support on the downside is near the 1.0820 level or the 76.4% Fib retracement level of the main upward move from the 1.0768 low to 1.0990 high. The main support is near the 1.0770 level, below which the EUR/USD pair could decline further towards the 1.0650 level.

On the upside, there is a major resistance forming near the 1.0950 area and a connecting bearish trend line. Therefore, the bulls need to gain traction above 1.0950 to start a fresh increase.

Fundamentally, the Euro Zone CPI report for March 2020 was released by the Eurostat. The market was looking for a 0.7% increase in the CPI compared with the same month a year ago.

The actual result was in line with the forecast, as the Euro Zone CPI increased 0.7% in March 2020 (YoY). Looking at the monthly change, the CPI increased 0.5%, more than the last 0.2% and similar to the forecast.

The report added:

In March, the highest contribution to the annual euro area inflation rate came from services (+0.60 percentage points, pp), followed by food, alcohol & tobacco (+0.46 pp), non-energy industrial goods (+0.13 pp) and energy (-0.45 pp).

Overall, EUR/USD must climb above 1.0950 to avert more downsides below 1.0820. Conversely, GBP/USD is showing a lot of positive signs above 1.2400.

Upcoming Economic Releases

- German Producer Price Index for March 2020 (MoM) – Forecast -0.1%, versus -0.4% previous.

- Euro Zone Trade Balance Feb 2020 – Forecast €2.0B versus €17.3B previous.

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals