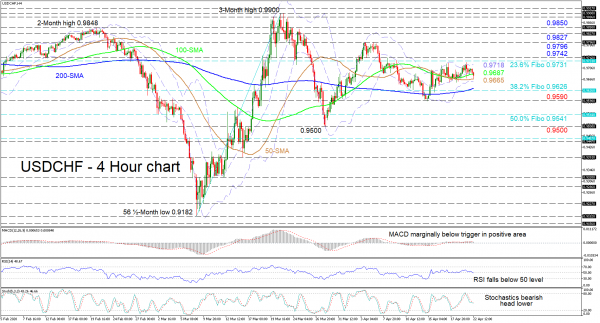

USDCHF has been mainly flat for the last two weeks confined within the 0.9742 and 0.9590 boundaries. Confirming the mostly directionless market are the 50- and 100-period simple moving averages (SMAs’) uncertain signals and the sideways demeanour of the 200-period SMA.

The short-term oscillators, although tilting marginally negative, suggest that directional momentum has dried up. The MACD is slightly above the zero mark but below its red trigger line, while the RSI has just dipped below the 50 mark. Moreover, the stochastics reflect weakening momentum as they point lower.

To the downside, immediate support could come from the 50-period SMA at 0.9665 and the lower Bollinger band beneath, ahead of the 200-period SMA near the 0.9626 level, which is the 38.2% Fibonacci retracement of the up leg from 0.9182 to 0.9900. Pushing past these, the 0.9590 boundary could come in defence of the descent towards the 50.0% Fibo of 0.9541 and the 0.9500 trough.

If buyers take the upper hand and steer above the 100-period SMA at 0.9687, the next limiting obstacle could come at the upper Bollinger band at 0.9718. A step higher encounters a resistance region from the 23.6% Fibo of 0.9731 until the upper boundary of 0.9742, which if overrun could shoot the pair towards the 0.9796 peak of April 6. Further advances could shift the attention to the 0.9827 and 0.9850 highs around the end of March.

Overall, the pair remains neutral in the short-term picture with a break above 0.9742 or below 0.9590 needed to establish the next direction.

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals