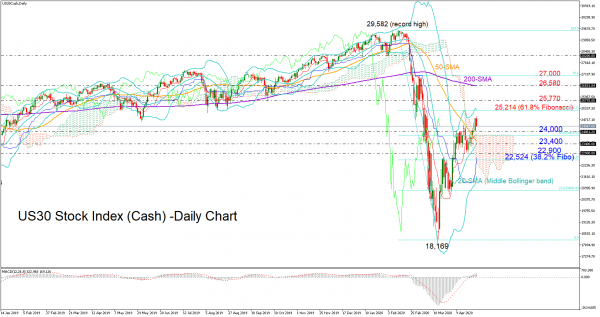

The US 30 stock index (cash) closed positive above the Ichimoku cloud on Wednesday, increasing speculation that the short-term uptrend could further strengthen. A bullish cross of the 20-day simple moving average (SMA) with the 50-day SMA may add to the sentiment if it is finally completed.

The fact that the price has yet to touch the upper Bollinger band at a time the MACD keeps rising above its zero and signal lines is also hinting that the next move in the price may be up.

Therefore, the focus could remain on the upside in the short-term, with traders likely searching for resistance near 25,214, which is the 61.8% Fibonacci retracement level of the down leg from 29,582 to 18,169. If the bulls breach that barrier, some consolidation could follow around 25,770 before the 200-day SMA currently near 26,580 comes into view.

On the downside, sellers could dominate if the price retreats below 24,000, pushing support towards the 50-day SMA and the middle Bollinger band at 23,400. Failure to rebound at this point, may trigger another sell-off towards 22,900 and the 38.2% Fibonacci of 22,524. Further declines beneath the latter would put the short-term uptrend under speculation.

Meanwhile in the medium-term picture, the index maintains a bearish profile, though a weaker one, as long as the price trades below 27,000.

Summarizing, the US 30 index is expected to gain extra ground in the short-term, with immediate resistance likely emerging around 25,214.

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals