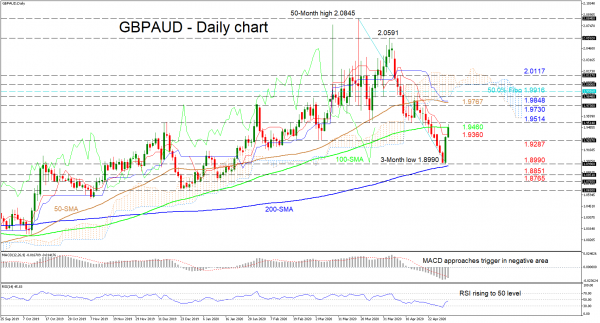

GBPAUD is currently pushing up against the 100-day simple moving average (SMA) at 1.9460 after a bounce near the 200-day SMA’s region, which ultimately kept intact the medium-term positive outlook.

Looking at the short-term oscillators, they paint an optimistic picture. The MACD is in the negative region and below its red trigger line but looks to move back above it, while the RSI is rising towards its neutral threshold. Furthermore, the 50- and 100-day SMAs maintain a positive tone despite somewhat flattening. That said the Ichimoku lines, although negative, have turned flat, which could reflect an end to the downside move.

If buyers manage to sustain the pullback above the 100-day SMA at 1.9460 and the 1.9514 level, the price may shoot for the swing high of 1.9730 and the 50-day SMA at 1.9767 overhead. Next, the 1.9848 resistance and the 50.0% Fibo of 1.9916 could come ahead of the lower band of the Ichimoku cloud at the 2.0000 mark. Pushing past the cloud the 2.0117 barrier could draw focus.

If sellers retake control, the red Tenkan-sen line at 1.9360 could hinder the drop to the 1.9287 support. Moving lower, a revisit of the 3-year low of 1.8990 and 200-day SMA beneath could unfold. Diving past the 200-day SMA, the 1.8851 and 1.8765 lows from around January 2020 may come into play.

Overall, the medium-term bias remains bullish above the 200-day SMA and the 1.8990 trough, while a close above 1.9916 could realign the very short-term outlook with the bigger one.

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals