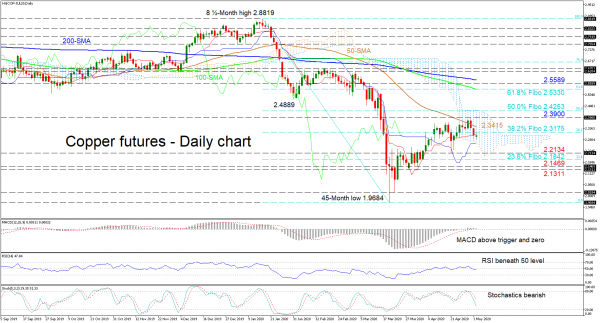

Copper futures’ correction seems to be faltering below the 50-day simple moving average (SMA) and under the 2.3175 level – that being the 38.2% Fibonacci retracement of the down leg from 2.8819 to 1.9684 – as it edges in the Ichimoku cloud. The Ichimoku lines support the bullish run as does the MACD, which is for now, just above its red trigger and zero line.

That said, the RSI, just below its neutral threshold, and the falling stochastics back a deteriorating very short-term picture. Additionally, the SMAs are holding true with the bigger negative sentiment in place.

If sellers retake the reins, initial support could come from the flattened blue Kijun-sen line ahead of the 2.2134 low. Declining further, the 23.6% Fibo of 2.1842 could prevent the price from challenging the 2.1469 and 2.1311 troughs from April 2 and March 30.

If buying interest picks up, initial resistance could come from the 38.2% Fibo of 2.3175 ahead of the 50-day SMA at 2.3415. Pushing up, the 2.3900 nearby obstacle may apply some pressure before the attention turns to the upper band of the Ichimoku cloud, coupled with the 50.0% Fibo at 2.4253. Overcoming this could rally the commodity towards the 61.8% Fibo of 2.5330 – where the 100-day SMA resides – and the 2.5589 peak.

Overall, the short-term timeframe maintains a bearish bearing below the SMAs and the 2.3900 barrier, while a close below 2.1842 could boost the negative outlook.

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals