US stocks rallied yesterday as the market reflected on some positive news from the US. The rally was mostly because certain US officials ruled against retaliating against China. This is after Trump last week suggested that he would apply fresh tariffs on the country for causing the coronavirus pandemic. The market also rallied because of the surging crude oil prices and the drugs being developed to fight the coronavirus pandemic. Still, some analysts are cautious because of the rising number of coronavirus cases in the United States and weak corporate earnings. Dow Jones, Nasdaq, and S&P500 rose by almost 2%.

The New Zealand dollar was little changed against the US dollar after Statistics New Zealand released encouraging employment data. The numbers showed that the unemployment rate rose to 4.1% in the first quarter as more people stayed at home and more companies remained closed. The closely-watched participation rate rose to 70.40% in the quarter while the employment change rose slightly by 0.7%. At the same time, labour cost remained unchanged at 2.4%. These numbers came at a time when New Zealand is reopening its economy because the number of coronavirus cases has reduced.

The Australian dollar rose after Australia released positive retail sales numbers. In March, sales rose by 8.5%, which was significantly higher than the expected 8.2%. The sales rose by 0.7% in the first quarter. Later today, we will receive the interest rate decision from Norway, services PMI data from Europe, construction PMI from the UK, mortgage data, and oil inventories from the US. The inventories will come at a time when the price of crude oil has started to rally as traders start pricing-in the eventual opening of the economy.

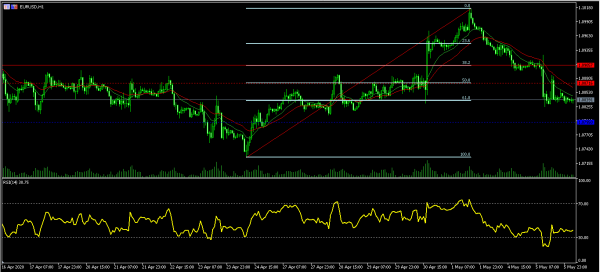

EUR/USD

The EUR/USD pair declined during the American session but remained unchanged at 1.0838 during the Asian session. On the hourly chart, the price is slightly below the 14-day and 28-day exponential moving average and along the 23.6% Fibonacci retracement data. The RSI has stabilised above the oversold level of 30. Therefore, the pair may continue falling if bears manage to push it below the 23.6% retracement level. In this case, they will attempt to test the important support at 1.795.

XBR/USD

The XBR/USD pair rose sharply during the American session. The pair is trading at 31.30, which is the highest it has been since April 20. The price is between the 23.6% and 38.2% Fibonacci retracement level while the RSI has moved above 70. Also, the dots of the Parabolic SAR are below the price. Therefore, it is likely that bulls will attempt to test the 38.2% retracement level at 34.37.

NZD/USD

The NZD/USD pair rose slightly after the encouraging jobs report. It is now trading at 0.6050, which is slightly higher than yesterday’s low of 0.6036. On the hourly chart, the price is slightly above the 50% retracement level. With the pair moving sideways, it means that a breakout could happen in either direction. As a result, the key support and resistance levels to watch are 0.6000 and 0.6075 respectively.

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals