The US employment report for April will hit the markets at 12:30 GMT on Friday and will reveal just how much economic damage the pandemic has inflicted on the American economy. Forecasts point to a breath-taking 21.8 million job losses, which would push the unemployment rate up to a staggering 16%. As for the dollar, economic data have little impact nowadays, so its near-term direction may depend on risk appetite. Overall, it’s still difficult to envision any real weakness in the reserve currency.

It’s a horror story

If forecasts prove accurate this week, then the US will have lost every job created over the entire past decade and the unemployment rate will hit its highest level since World War Two, far surpassing the 10% peak of the last recession.

What’s truly terrifying though, is that the unemployment rate is probably even higher today. This jobs survey was conducted in the second week of April, and since then, the number of people applying for unemployment benefits has remained alarmingly high. Therefore, even more losses will probably follow next month.

Another spot to watch is the labor force participation rate. This is important because if the unemployment rate is better than expected for example, that might be because many people weren’t looking for a job right after being laid off and therefore weren’t counted as ‘unemployed’. In this case, they are calculated as being out of the labor force, which artificially deflates the unemployment rate.

Does data matter anymore?

One could easily argue they don’t, as we have seen very little market movement lately even after scary data. The markets didn’t care when weekly jobless claims showed millions upon millions of Americans being laid off, and they didn’t move when US GDP contracted by more than expected in Q1, so this NFP could be just another piece of bad news that everyone expects already.

However, at some point soon, data will begin to matter again. Once we pass the stage of ‘we know it will be a bloodbath’ and enter the phase of ‘we should be recovering by now’, then markets could get back in a macro mood. In other words, data may start to matter only when the lockdowns are lifted, and investors begin to focus on which economies are coming out of the recession first.

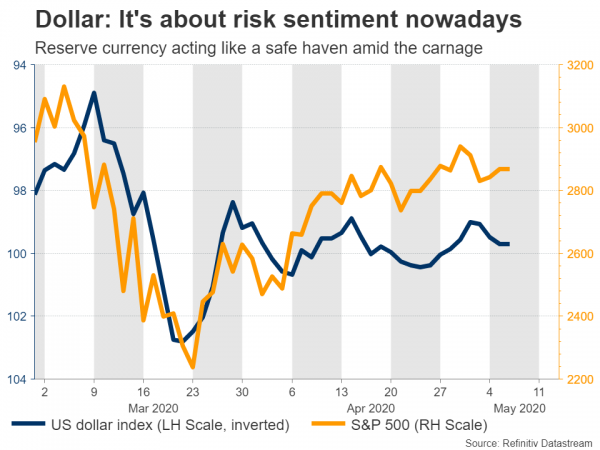

Dollar unlikely to lose its mojo

As for the dollar, it’s still difficult to envision any sustained weakness. The Fed has already done almost everything in its power to weaken it, and yet the greenback remains stubbornly strong as there are very few viable alternatives. The euro for example doesn’t look attractive at all, as the Eurozone is mired in institutional problems that will exacerbate this crisis. Its weak structure resulted in a rather small stimulus package that came late and didn’t include a burden-sharing mechanism to help ruined economies like Italy and Spain.

If anything, the near-term outlook for the dollar looks cautiously positive, mainly due to its safe haven qualities. In this sense, the risk of another turn lower in stocks from here – which benefits the dollar – seems rather high. A lot of good news has been priced back into markets and current stock valuations imply a V-shaped economic recovery, which is probably unrealistic.

Consider how many businesses will shut down permanently or will operate at reduced capacity for many months, the long-term impact on consumption from exploding unemployment, the lasting behavioral shock to some consumers, and what crumbling US-China relations mean for global trade. Finally, it remains to be seen whether the re-opening of the economy will go smoothly, as investors currently envision.

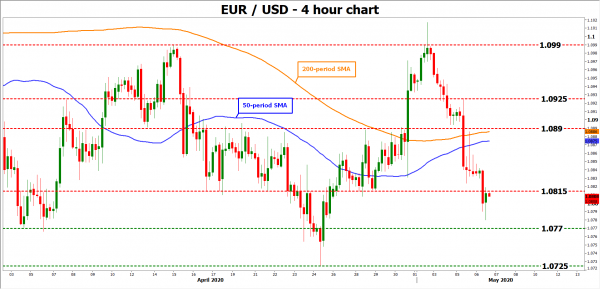

Taking a technical look at euro/dollar, if the bears stay in charge, their next target might be the 1.0770 zone. If violated too, support may then be found around 1.0725.

On the upside, a move back above 1.0815 could open the door for a test of the 1.0890 territory.

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals