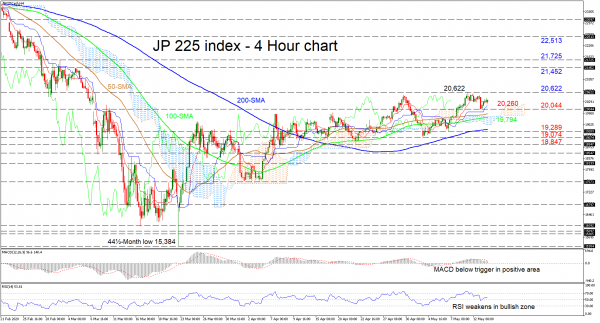

JP 225 stock index (Cash) continues to gradually appreciate backed by the positively charged simple moving averages (SMAs). Further fuelling the upward incline, are the Ichimoku lines – though slightly weakened – and the Ichimoku cloud.

Glancing at the short-term oscillators, they too reflect some stalling in momentum despite remaining in positive territories. The MACD, in the positive section, has slipped below its red signal line, while the RSI, above its neutral threshold has turned downwards.

If the positive structure persists, initial resistance could come from the 20,622 level. Jumping above this may send the index towards the 21,452 and 21,725 swing highs from around the beginning of March. Another run above these obstacles may meet the 22,513 peak from February 26.

Should sellers steer below the red Tenkan-sen line at 20,260, first to stall the decline is the 20,044 barrier. A step lower may encounter strong support from the upper band of the Ichimoku cloud at 19,794, which is sandwiched between the 50- and 100-period SMAS. Diving down, the low of 19,289 coupled with the 200-period SMA may halt the descent, while sustained selling could stretch towards the 19,074 and 18,847 troughs.

Overall, the very short-term positive structure remains intact above the 19,289 trough and a break above 20,622 could repower this outlook.

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals