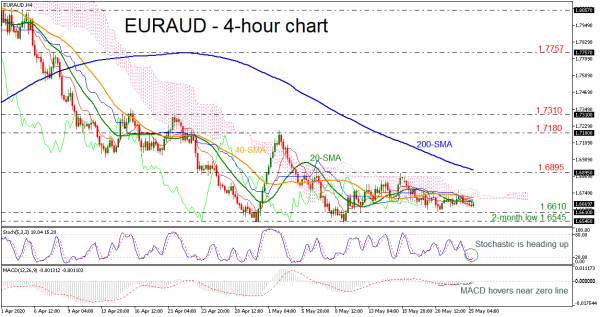

Technical Analysis – EURAUD appears flat below Ichimoku cloudEURAUD has been trading within a consolidation area over the last couple of weeks with upper boundary the 1.6895 resistance and lower boundary the 1.6610 support level. The pair is capped by the 20- and 40-period simple moving averages (SMAs) and the Ichimoku cloud in the 4-hour chart, suggesting that the bias seems to be neutral-to-bearish.

However, the technical indicators are giving some signals for an upside retracement. The stochastic posted a bullish crossover within its %K and %D lines in the oversold zone, while the MACD is rising above its trigger line in the negative region.

If the bulls manage to take charge and jump above the upper band of the aforementioned channel and the 200-period SMA, then traders would expect them to pull the trigger for another test near the 1.7180 resistance hurdle. That said, we would like to see a clear break above 1.7310 to gather confidence for larger upside extensions. Such a break would confirm a forthcoming higher high on the 4-hour chart and may pave the way towards the next obstacle of 1.7757, defined by the peak on April 15.

A clear dip below 1.6610 would bring the pair back into a bearish picture and may set the stage for declines towards the two-month trough of 1.6545. Such a slip may carry more downside extensions and may open the path towards the next support of 1.6455, marked by the inside swing high on February 2.

To summarize, EURAUD looks neutral in the very short-term, while in the medium-term the picture is seen bearish unless the price breaks above 1.7757.

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals