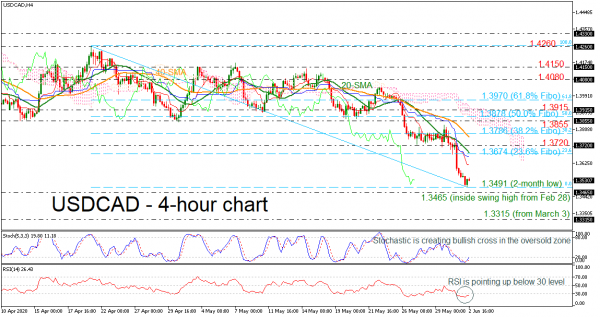

USDCAD extended Monday’s losses and is currently trading not far above a two-month low of 1.3491 hit earlier today. The strong bearish rally started has been evolving since April 21. However, the momentum indicators are suggesting a possible pullback in the very short-term. The stochastic oscillator is creating a bullish crossover in the oversold zone and the RSI is sloping up below the 30 level.

Further declines may meet support around the inside swing high from February 28 at 1.3465. Even lower, the low from March 3 would be eyed before meeting the 1.3200 psychological mark.

On the upside, resistance could occur around the 23.6% Fibonacci retracement level of the down leg from 1.4260 to 1.3491 at 1.3674, which stands near the 20-period simple moving average (SMA) at 1.3694. Higher still, the 1.3720 barrier and the 1.3786 level, being the 38.2% Fibo and overlapping with the 40-period SMA, would increasingly come into scope.

The short-term picture continues to look predominantly bearish, with trading activity taking place above both the 20- and 40-period SMAs and the Ichimoku indicator despite the positive picture of the technical indicators.

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals