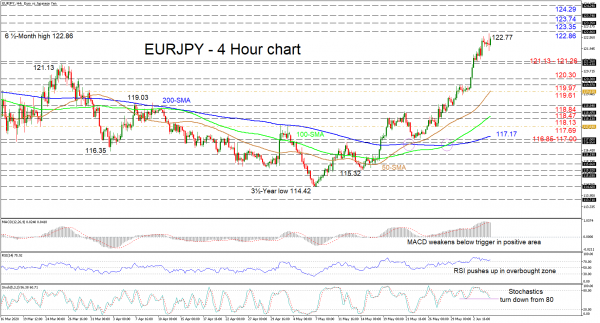

EURJPY’s one-month positive incline is stalling ahead of the key 122.86 resistance border. Although positive momentum appears to be waning, the ascent from the 3½-year low remains intact, something also reflected by the upward slopes within the simple moving averages (SMAs).

The short-term oscillators appear to be holding on to their positive tone, though slipping slightly. The MACD, deep in the positive region, has slipped below its red signal line but looks to move back above it, while the RSI marginally improves above the 70 mark. Furthermore, despite demonstrating weakness, the stochastic oscillator has yet to breach its previous low, thus a pullback cannot be ruled out.

To the upside, buyers face an initial tough resistance at 122.86 from January 16. Conquering this border, the pair may jump towards the 123.35 and 123.74 highs from July 1 and May 21 of 2019, before challenging the peak of 124.29, achieved at the beginning of May last year.

Should sellers manage to steer the price lower, first support may surface from the 121.26 – 121.13 section of previous highs, before a retracement tests the 120.30 – 119.61 obstacles, where the 50-period SMA also lies. Moving under the critical 119.61 mark, the price could plunge to challenge the 118.84 – 118.13 area of congested swing lows, which also encompass the 100-period SMA, before the attention turns to the 117.69 essential barrier.

In brief, the short-term bias is strongly bullish and a break above 122.86 would upgrade the positive outlook. Yet, a close below 117.00 could neutralise the recent growth in the pair.

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals