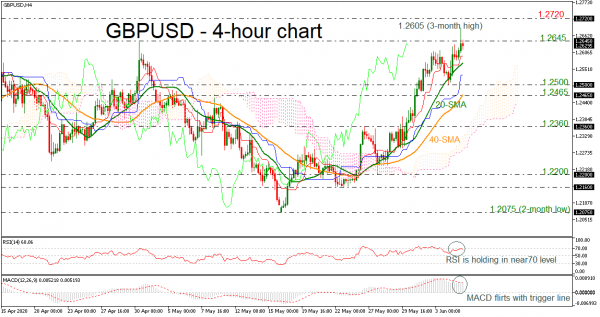

GBPUSD spiked towards a three-month high of 1.2705 but it finished the session below the 1.2645 barrier on Thursday. The upside rally which started after the rebound on the 1.2075 support could take a breather in the near term as the momentum indicators are suggesting a pullback. The RSI is edging south below the 70 level, while the MACD is holding beneath its red trigger line.

A declining move could find immediate support at the flat red Tenkan-sen line around 1.2590 and the 20-period simple moving average (SMA) at 1.2573. Lower still, the blue Kijun-sen line at 1.2533 and the 1.2500 handle could also provide some footing near the Ichimoku cloud. Breaking these lines, the 40-period SMA, which overlaps with the 1.2465 support, could come into the spotlight.

Alternatively, if there is a successful break above the 1.2645 resistance, and today’s high, the price could revisit the 1.2720 hurdle, taken from the inside swing low on February 28. An extension above it could pave the way for significant gains until the 1.3200 psychological mark, achieved on March 9.

Summarizing, GBPUSD maintains a bullish mode for now in the short-term and any advances above 1.2720 could shift the medium-term outlook from neutral to bullish.

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals