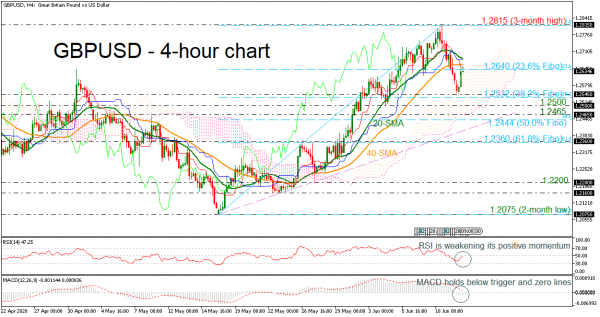

GBPUSD is trading around the vicinity of 1.2640, that being the 23.6% Fibonacci retracement of the upward wave from 1.2075 to 1.2815 and where the red Tenkan-sen line currently lies.

The price is eating a portion of its last sessions’ losses but the RSI and the MACD are consolidating in the negative areas avoiding giving any signals in the short term.

Still, the market seems to be well supported by the Ichimoku cloud and the 38.2% Fibonacci of 1.2532. If the bulls dominate above 1.2640, the spotlight would shift back to the 40- and 20-period simple moving averages, which stand near 1.2660 and 1.2680 respectively, a break of which would extend the uptrend towards the three-month peak of 1.2815.

On the other hand, selling interest could head the price until the 1.2545 trough and the 38.2% Fibonacci of 1.2532. To reach that floor and re-challenge the 1.2465 level, the price should first breach the lower surface of the Ichimoku cloud and the 1.2500 critical region, while below the short-term rising trend line and the 50.0% Fibo of 1.2444 the bears are eagerly waiting to take full control and drive towards the 61.8% Fibo of 1.2360.

In brief, Cable is expected to hold an upward direction unless the price closes significantly below the ascending trendline, which has been standing since May 18, and the 61.8% Fibonacci of 1.2360.

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals