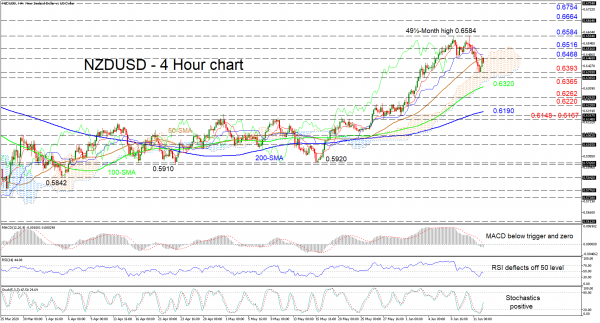

NZDUSD is currently restricted by the 50-period simple moving average (SMA) residing at the level of the inside swing low of 0.6468. The pair is dealing with selling pressures, which appear to be strengthening, something also reflected in the Ichimoku lines as well as the RSI and the MACD indicators.

Despite a pause in negative momentum in the MACD, it has distanced itself below its red trigger line and the zero mark, whilst the RSI has returned lower ahead of the 50 threshold. However, promoting gains is the bullish bearing in the SMAs and the positive tone presently within the stochastic %K and %D lines.

If sellers manage to sink into the cloud, initial support could develop from the 0.6393 trough to the 0.6365 barrier that also encompass the lower surface of the cloud. Plunging beneath, the 100-period SMA at 0.6320 and the swing low of 0.6262 could attempt to obstruct further declines. In the event steeper losses unfold, the 0.6220 obstacle may hinder the test of the tough 200-period SMA at 0.6190 and the crucial support region of 0.6148 – 0.6167.

Otherwise, if buyers drive the pair above the 0.6468 capping border, the 0.6516 high may prevent improvements to revisit the 49½-month peak of 0.6584. Overtaking this fresh top may boost gains towards the 0.6664 high from January 16, possibly extending until the 0.6754 barrier, which is the year end peak of 2019.

Summarizing, should the price remain above the 0.6365 – 0.6393 support region, this could sustain a bullish bias in the short-term timeframe. Yet, a break below 0.5920 could bring back worries of a negative outlook.

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals