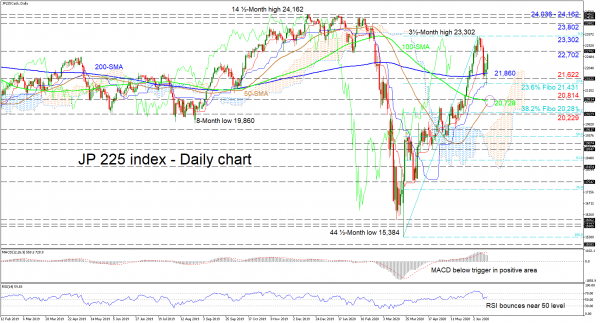

JP 225 stock index (Cash) yesterday bounced off the 21,431 mark, that being the 23.6% Fibonacci retracement of the up leg from 15,384 to 23,302, resuming the uptrend by climbing above the 200-day simple moving average (SMA).

The Ichimoku lines and the short-term oscillators, although reflecting the recent pullback, continue to back an improving picture overall. The MACD, despite falling below its red trigger line, remains deep in bullish territory, while the RSI is rising above its 50 level. Additionally the 50-day SMA is nearing a bullish crossover of the 100-day SMA at 20,728, which could inject fuel into the latest upside push.

If the price continues to ascend over the red Tenkan-sen line, early resistance may come at the 22,702 level ahead of the fresh three-and-a-half month peak at 23,302. Surpassing this, the index may jump to meet a vital high at 23,802 which stems back to February 20. A successful run over this could then shift the focus to the 24,036 – 24,162 area of critical tops.

Should sellers steer lower, the tough 200-day SMA at 21,860 could provide initial support ahead of the 21,622 hurdle and the key trough residing at the 23.6% Fibo of 21,431. Steeper losses below this mark could meet the 20,814 inside swing high and the bullish overlap just beneath at 20,728. Another step below the SMAs may see the 38.2% Fibo at 20,281 and the nearby 20,229 trough challenge the decline.

In brief, the short-term picture remains bullish above 21,431 and only a break below 20,229 could revive worries of negative tendencies returning.

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals