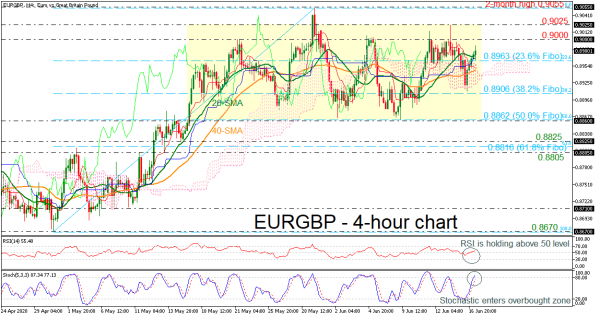

EURGBP has been developing within a consolidation area since May 15, despite the upside penetration at the end of the previous month. Looking at the last few days, the pair is extending a bullish move above the Ichimoku cloud and the 23.6% Fibonacci retracement level of the up leg from 0.8670 to 0.9055 at 0.8963, heading towards the 0.9000 psychological mark. The RSI is moving sideways above the neutral threshold of 50, while the stochastic entered the overbought zone.

A touch at the 0.9000 number could open the way for the 0.9025 resistance, taken from the bullish spike on June 15, before meeting the two-month peak of 0.9055. More advances could see a barrier far above the aforementioned levels at 0.9280, registered on March 25.

Alternatively, a dive beneath the 20-period simple moving average (SMA) and the 23.6% Fibo of 0.8963 could hit the 40-period SMA currently at 0.8947 and the lower surface of the Ichimoku cloud at 0.8938. Clearing these obstacles, could send prices until the 38.2% Fibo at 0.8906 and the lower band of the channel around the 50.0% Fibo of 0.8862.

Concluding, EURGBP retains the neutral picture in the 4-hour chart, while the momentum indicators suggest a bullish action.

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals