Key Highlights

- USD/CAD started a decent recovery wave from the 3-month low at 1.3315.

- There was a break above a major bearish trend line at 1.3455 on the 4-hours chart.

- Canada’s CPI decreased 0.4% in May 2020 (YoY), more than the last -0.2%.

- Canada’s ADP employment could change -280.3K in May 2020, more than the last -226.7K.

USD/CAD Technical Analysis

In the past few weeks, the US Dollar remained in a bearish zone from well above 1.4000 against the Canadian Dollar. USD/CAD traded to a new 3-month low at 1.3315 and recently started a strong recovery.

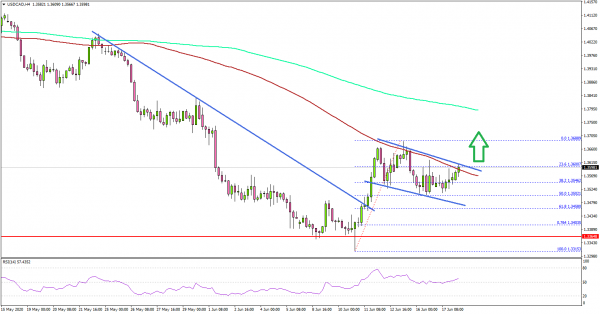

Looking at the 4-hours chart, the pair broke a few key hurdles near the 1.3400 area to move into a short-term positive zone. There was also a break above a major bearish trend line at 1.3455.

It opened the doors for more gains above the 1.3500 resistance. The pair even climbed above the 1.3600 level this past week, but it struggled to clear the 100 simple moving average (red, 4-hours).

A high is formed near 1.3688 and the pair is currently correcting lower. It already tested the 50% Fib retracement level of the upward move from the 1.3315 low to 1.3688 high. It seems like there is a bullish flag pattern forming with resistance near the 1.3600 level.

If USD/CAD clears the channel resistance and settles above the 100 simple moving average (red, 4-hours), it could start a strong increase. The next major resistance is seen near the 1.3800 level and the 200 simple moving average (green, 4-hours).

Conversely, the pair might fail to climb above 1.3600 and it could continue to move down. The key support is seen near the 1.3450 level, below which the pair might retest the 1.3320 area.

Fundamentally, the Consumer Price Index (CPI) for May 2020 was released by the Statistics Canada. The market was looking for no change in the CPI compared with the same month a year ago.

The actual result was disappointing, as the Canadian CPI declined 0.4% (YoY). Looking at the monthly change, there was a 0.3% increase in the CPI, less than the 0.7% market forecast.

The report added:

Excluding gasoline, the CPI rose 0.7%, the smallest increase since January 2013. On a seasonally adjusted monthly basis, the CPI increased 0.1% in May. Among the major components, the transportation index (+2.7%) was the only one to increase, driven by higher gasoline prices in May.

Overall, USD/CAD could start a strong recovery if it clears the 1.3600 resistance. Looking at EUR/USD, the pair struggled to continue above the 1.1320 resistance, and GBP/USD is facing hurdles near 1.2600 and 1.2640.

Upcoming Economic Releases

- BoE Interest Rate Decision – Forecast 0.1%, versus 0.1% previous.

- US Initial Jobless Claims – Forecast 1300K, versus 1542K previous.

- Canada’s ADP Employment Change May 2020 – Forecast -280.3K, versus -226.7K previous.

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals