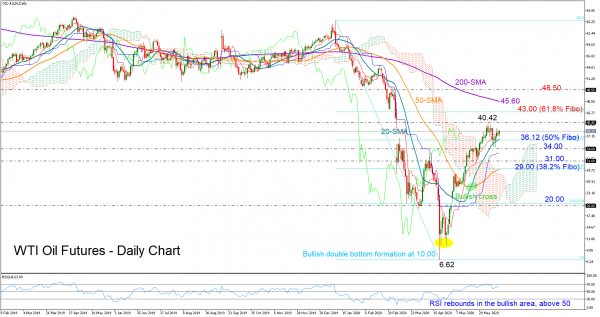

WTI oil futures for July delivery maintain a clear positive structure reflected by the higher highs and the higher lows since late April, with the price printing another higher trough at 34.35 last week.

Now it remains to be seen if the outlook can improve beyond the 40.42 peak, which is likely given the recent rebound in the RSI. For that to happen, the 50% Fibonacci of the downleg from 65.61 to 6.62 and the 20-day simple moving average (SMA) both around 36.12 need to hold firm and establish a strong footing under the price. Above 40.42, the price may next lose steam somewhere between the 61.8% Fibonacci of 43.00 and the 200-day SMA before meeting the 48.50 resistance region. Higher, an outlook improvement could occur in the medium-term window, switching the sentiment from bearish to neutral.

On the other hand, if sellers drive below 36.00, the 34.00 number may come to the rescue, potentially rejecting any move towards the 29.00-31.00 region where the 50-day SMA and the 38.2% Fibonacci are placed.

In brief, WTI oil futures may keep seeking higher highs in the short-term if any downside pressure is contained near 36.00.

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals