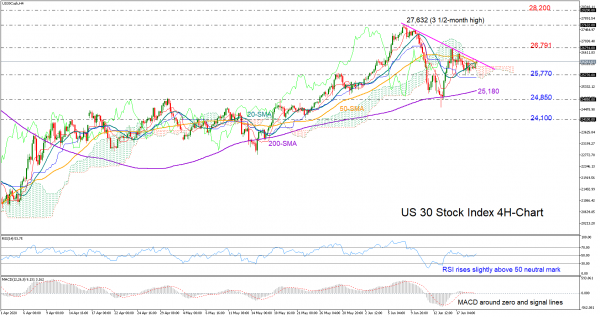

The upward pattern in US 30 stock index (cash) lost some shine after the print of a lower high at 26,791 in the four chart, but the positive trend remains valid as long as the market action develops above 24,850.

Looking at the short-term window, the index is trapped between a descending trendline and the 25,770 support area and unless one of these borders collapses, the neutral mode is likely to stay intact.

Technically, the bias is viewed as cautiously positive given the latest rebound in the RSI and the barely rising MACD, which continues to hold tight near its trigger and zero lines. But a move above the trendline is needed to boost positive sentiment and expose the pair to the swing high of 26,791. Beyond that mark, the bulls would aim for the 3 ½-month high of 27,632, a break of which could see the retest of the 28,200 barrier – this being a key resistance and support level from November onwards.

Sellers could take the lead below 25,770, with all attention turning to the 200-period simple moving average (SMA) currently around 25,180, which managed to push the index back into the green territory this month. Failure to hold above this line may pressure the price towards the 24,840 hurdle, where any close lower could trigger a sharper decline to 24,100.

Summarizing, the US 30 stock index is expected to hold neutral in the near-term unless it crosses above the descending trendline or falls below 25,770. Nevertheless, the broader uptrend remains safe for now and as long as the price trades above 24,850.

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals