Markets will remain tuned to virus news in the coming week, as the battle between stimulus-fueled optimism and second wave fears rages on. The US virus count might be what tips the scales, not just for stocks but for currencies also, as risk appetite has become the dominant force in the FX arena now that the dollar is acting like a haven. Elsewhere, the RBNZ is unlikely to do or say much, while PMIs from around the globe will tell us how quickly each economy is recovering. Finally, mind the weekend risk from China.

Stimulus-driven exuberance vs real life

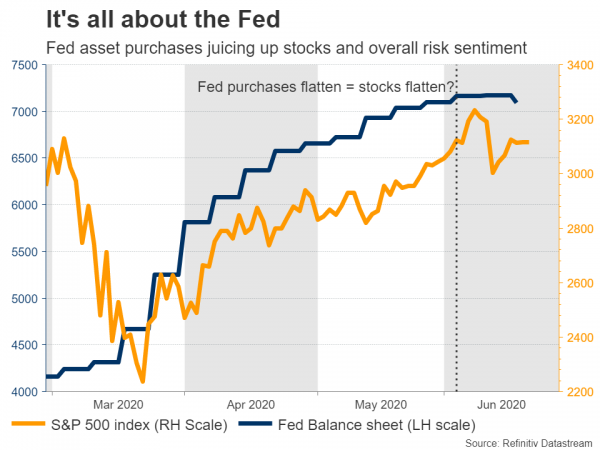

There has never been a market quite like this one. Investors seem almost blind to the many risks around them, as the tsunami of stimulus has obliterated fear, resulting in a crescendo of euphoria so great that the aussie has rallied 25% from its lows and the Nasdaq has conquered new heights. In the real world meanwhile, unemployment is rampant, social and geopolitical unrest is the sign of the times, and some regions may be in the early stages of another infection wave.

But hey, if the Fed is even buying junk bonds, and if it verbally intervenes every time there’s the slightest correction, what’s the point of worrying, right? That is, until it’s really time to worry. If you condition markets not to care about risks, they won’t, until something so big comes along that they can’t ignore. Then, panic can ensue, and that’s the real risk.

Are the bulls right to assume things will be much better in a year’s time and frontload that optimism, or are the bears right that the disconnect between markets and the real economy has never been greater? Only time will tell, but for now, how this debate evolves will be the decisive factor not just for stocks but for currencies as well, which have basically become a reflection of risk sentiment lately.

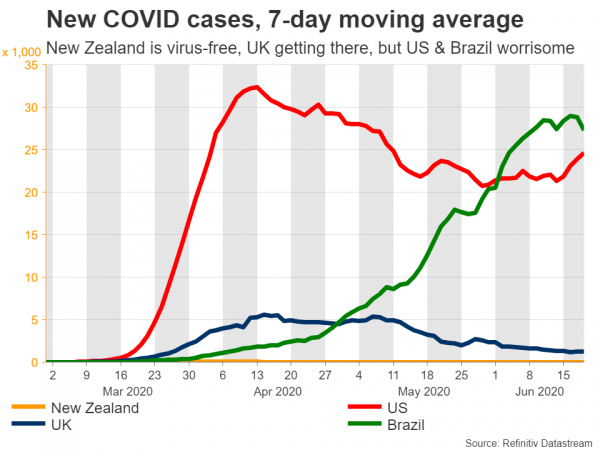

Specifically, will the worrisome resurgence in US virus cases overpower the ‘animal spirits’ that the Fed has awakened? So far it hasn’t – but keep an eye on those virus numbers.

Also keep an eye out for quarter-end rebalancing flows by pension funds and such. With stocks having outperformed bonds so tremendously in Q2, equities might feel some pain heading into month-end as fund managers rebalance back to bonds. This could also spill over into FX through the ‘risk’ channel, boosting safe havens to the detriment of commodity currencies.

RBNZ: Optimistic, but not too much

New Zealand is one of the few countries that can claim it has successfully eradicated the deadly virus, and the Reserve Bank will probably be feeling good when it meets on Wednesday, as the economy has exited the lockdown much faster than policymakers assumed in their latest forecasts. That allows for a faster return to economic growth.

But the RBNZ will be careful not to sound too optimistic, for fear of propelling the kiwi even higher. The currency has gained 17% from its March lows and is now comfortably above its pre-crisis levels, which is a problem as it makes the nation’s exports less competitive abroad. Furthermore, even if New Zealand is virus-free, its borders will still remain closed for a long time, which could decimate the tourism industry.

The point is that recent developments have surely been better than expected, but the economy is not out of the woods and many risks linger. Hence, the RBNZ will probably maintain a balanced tone, highlighting the encouraging news but simultaneously reaffirming that it stands ready to do more if needed, thereby keeping a lid on the kiwi’s advance.

European PMIs to underscore rebound, but British ones might not

In euro land, the preliminary PMIs for June – out on Tuesday – could set the tone. With European economies removing most lockdown restrictions in recent weeks, businesses will probably be feeling much better, and that might be reflected in the PMIs. This could give the euro a small shot in the arm, but the real drivers will be risk sentiment and any news on the EU negotiations about a recovery fund.

With the dollar effectively becoming a mirror reflection of stock markets, euro/dollar mostly trades in the same direction as equities nowadays, so without any updates on the recovery fund negotiations, the main variable will be risk appetite. The minutes of the latest ECB meeting are also out on Thursday, though any new revelations are unlikely.

Staying in Europe, the British PMIs – also out on Tuesday – might not be quite as cheerful. The UK only started to lift its lockdown measures in early June and many non-essential shops like electronics and clothing only opened on June 15. Other businesses like pubs and restaurants are still closed.

Since the UK re-opening process is a few weeks behind Europe, any real improvement in the British PMIs may also come later, perhaps next month. As for the pound, given that Brexit negotiations won’t restart again until June 29, its primary driver will be risk sentiment.

Flood of outdated US data unlikely to excite dollar

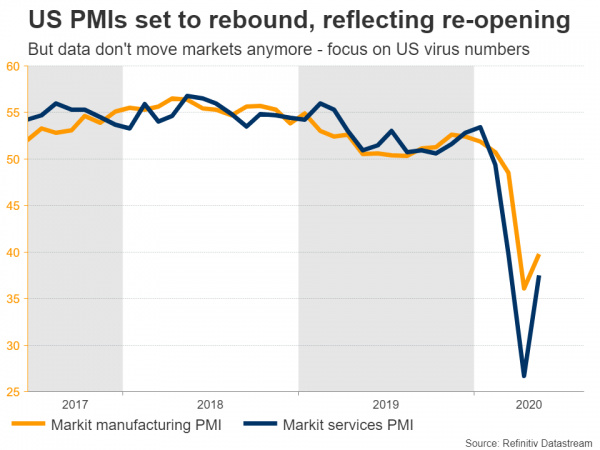

In America, there’s a raft of data coming up, but markets are unlikely to react much, as most figures may be viewed as outdated. On Tuesday, the preliminary Markit PMIs for June could tick higher to reflect the re-opening in most states, ahead of Thursday’s durable goods orders for May. Personal income and spending data for May, as well as the core PCE price index for that month, will all hit the markets Friday.

Instead of data, the dollar will likely react much more to the daily virus numbers that are coming out of Florida, Texas, California, and Arizona. These are some of the most populous US states, and all have displayed warning signs of another outbreak lately. Paradoxically though, a further spike in US virus cases might boost the dollar, given its haven-like characteristics.

Some weekend risk from China

Early on Monday, the People’s Bank of China (PBoC) will conclude its own policy meeting. While these events usually pass unnoticed, recent remarks from policymakers suggest that capital requirements on commercial banks will be cut further, perhaps as early as Monday.

The market effects of such a move would be similar to a rate cut, so if the PBoC does act, that might lift local stocks and to a lesser extent global stocks too as the week begins.

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals