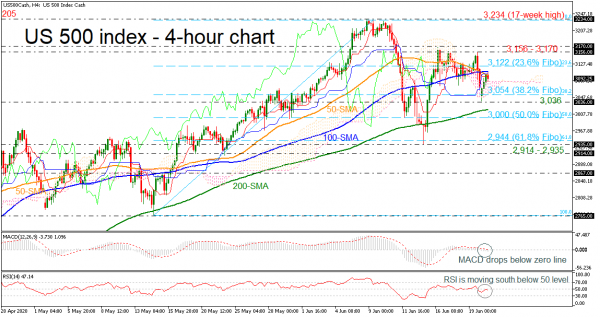

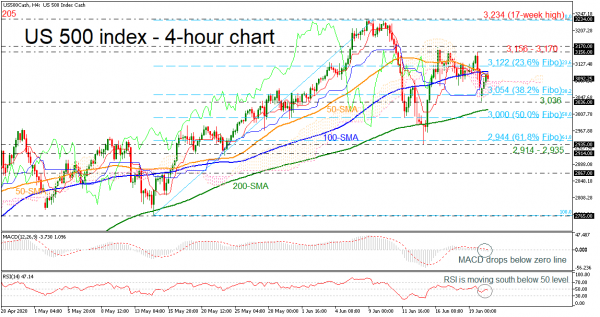

The US 500 cash index found strong resistance around the 100-period simple moving average (SMA) over the last session, sending the indicators lower as well. The MACD is heading south below zero and its trigger line, while the RSI is pointing down below the neutral level of 50. Also, the red Tenkan-sen line declined beneath the blue Kijun-sen line suggesting more losses in the 4-hour chart.

Should prices head lower, immediate support could come from the 38.2% Fibonacci retracement level of the upward wave from 2,765 to 3,234 at 3,054 before touching the 3,036 line. A breach of this level could open the door for the 200-period SMA currently at 3,018 ahead of the 3,000 psychological mark, which is the 50.0% Fibo.

On the flip side, a successful attempt above the 100-period SMA could send traders to look for some gains until the 23.6% Fibo of 3,122. Should the index strengthen its positive momentum, the next resistance could come around the 3,156 – 3,170 zone followed by the 17-week high of 3,234.

In the long-term, the outlook remains bullish, however, if the price were to jump above the 17-week peak, it could swift the short-term view back to a positive one.

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals