Key Highlights

- Gold price started a fresh rally and traded to a new multi-year high close to $1,780.

- A strong support is forming near $1,750 and $1,745 on the 4-hours chart of XAU/USD.

- The US Gross Domestic Product is likely to contract 5% in Q1 2020.

- The US Initial Jobless Claims in the week ending June 20, 2020 could improve from 1508K to 1300K.

Gold Price Technical Analysis

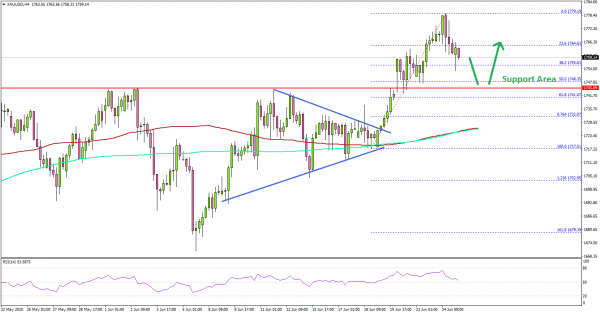

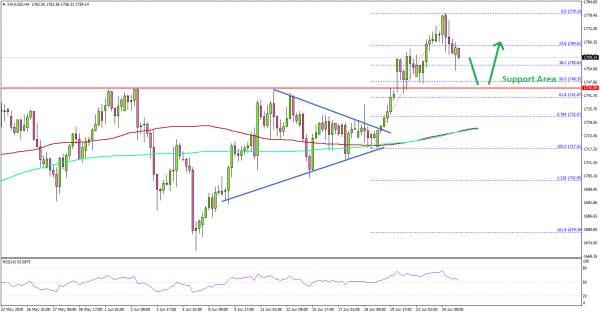

Earlier this month, gold price extended its decline below $1,700 against the US Dollar. The price found support near $1,680 and recently started a fresh rally above $1,700 and $1,745.

The 4-hours chart of XAU/USD indicates that the price broke many hurdles near $1,745 and $1,750 to start the current rally. There was also a break above a key contracting triangle with resistance near $1,725.

The price surged above $1,760 and traded to a new multi-year high close to $1,780. It corrected a few points below $1,770 from $1,779, and tested the 38.2% Fib retracement level of the upward move from the $1,717 swing low to $1,779 high.

However, there are a few strong supports are forming near $1,750 and $1,745. Moreover, the price is now well above the 100 simple moving average (red, 4-hours) and the 200 simple moving average (green, 4-hours).

If there is a substantial downside correction, the $1,745 support or the $1,725 support near the 100 SMA could provide support. The 50% Fib retracement level of the upward move from the $1,717 swing low to $1,779 high is also near $1,748.

On the upside, an initial resistance is near the $1,780 level, above which the price could stage a test of the $1,800 resistance zone in the coming sessions.

Looking at EUR/USD, the pair retreated lower from the 1.1350 region, and GBP/USD failed to surpass the 1.2550 resistance zone.

Economic Releases to Watch Today

- US Initial Jobless Claims – Forecast 1300K, versus 1508K previous.

- US Gross Domestic Product Q1 2020 – Forecast -5.0% versus previous -5.0%.

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals