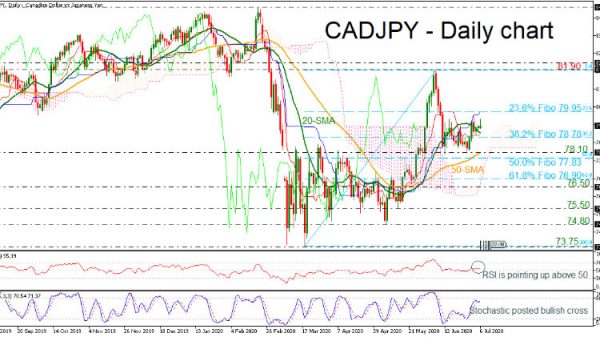

CADJPY is in the process to recover some of its aggressive losses that posted at the beginning of the previous month. The 50-day simple moving average (SMA) acted as a crucial support level for the price, while the RSI and the stochastic are moving slightly higher. However, the red Tenkan-sen line is holding beneath the blue Kijun-sen line, suggesting possible losses in the short-term.

In case that the price remains above the moving averages it could challenge the 79.95 resistance, being the 23.6% Fibonacci retracement level of the upward wave from 73.75 to 81.90. A rally above this hurdle could hit the 81.90 high.

Otherwise, a strong fall below the 20-day SMA and the 38.2% Fibo of 78.78 could open the door for the 78.10 support, which overlaps with the 50-day SMA. If the bears continue to sell the pair, the next barrier is coming from the 50.0% Fibo of 77.83 and the 61.8% Fibo of 76.90.

In brief, CADJPY has failed to improve the bullish structure that started from the rebound on 73.75. A jump above 81.90 could boost sentiment for more gains.

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals