U.S. Review

Jobless Claims Rise, Housing Market Rebounding

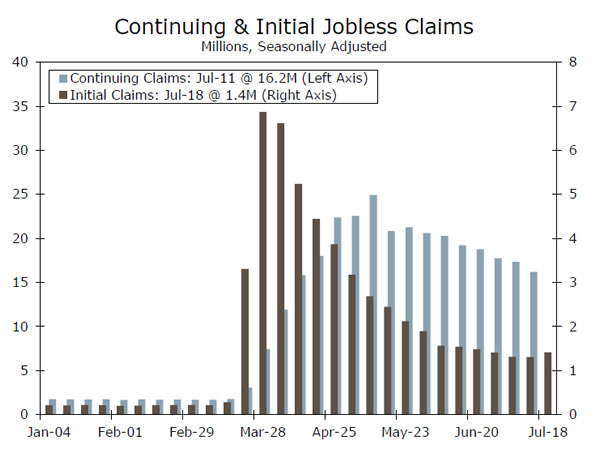

- Initial jobless claims rose to just over 1.4 million for the week ending July 18. Continuing claims fell to about 16.2 million. Initial claims edging higher suggests that the resurgence of COVID-19 may be taking a toll on the labor market recovery.

- Record low mortgage rates have spurred a rebound in the housing market. Existing home sales jumped 20.7% and new home sales rose 13.8% during June. More improvement is on the way, as purchase mortgage applications continue to climb.

- The Leading Economic Index (LEI) moderated slightly, but still increased 2.0%. Overall, the U.S. economic recovery continues, but the pace of improvement appears to be slowing.

Jobless Claims Rise, Housing Market Rebounding

It was a relatively light week in terms of new economic data. Initial jobless claims for the week ending July 18 rose to just over 1.4 million, which was the first increase since the end of March. Continuing claims, which lag by a week, fell to 16.2 million.

The uptick in initial claims is likely the result of more restrictive measures taken in recent weeks to combat the resurgence in new COVID-19 cases around the country. Seasonal factors have perhaps created some noise lately (the number of claims fell slightly over the week on a non-seasonally adjusted basis), however the improving trend in claims seen over the past few months has likely stalled-out.

Critically, the upturn in claims comes just a week before federal emergency unemployment benefits are set to expire. Discussions on another round of fiscal relief started this week, but nothing is set in stone. These benefits have been a boon for household incomes, helping fuel the quick bounce back in consumer spending. With layoffs now back on the rise and 32 million individuals currently receiving either state or federal benefits, we doubt Congress will let them fully lapse.

What’s more, household finances being shored up by the CARES Act may help explain the relatively swift rebound in the housing market. Existing home sales jumped 20.7% during June to a 4.72 million-unit pace. That pace is still below the peak hit in February, but the steady rise in mortgage applications suggests even more improvement is on the way. Weekly mortgage purchase applications were up nearly 20% over the year for the week ending July 17. Mortgage rates have tested record lows in recent weeks, which is providing incentive for more renters to become homeowners.

The resiliency of housing lately may seem inconsistent with high unemployment. Job losses have been centered in the hospitality and retail sectors, however, where workers tend to be younger and are more likely to be renters rather than home buyers. The residual effects of the pandemic also appear to be altering the type and location of homes rented and sold. Renters in dense urban markets look to be flocking to the suburbs, where social distancing is easier. The rise of remote work has also made having an extra room and additional usable square footage more important. On top of this, life in the city has probably lost some its luster, with bars, nightclubs and cultural attractions now closed for the most part.

One potential impediment for continued improvement in the housing market, however, is the continued lack of homes available for sale. For-sale inventories rose modestly in June, increasing 1.3% to 1.57-million units, but that still left inventories about 18% lower than their year-ago level. Tight supplies of existing homes for sale may be pushing buyers toward new homes. Sales of new homes surged 13.8% during June to a 776,000-unit pace, the fastest since 2007.

Housing is a clear bright spot, but the broader economic recovery may be starting to lose steam. The reemergence of COVID-19 in many parts of the country has led to tighter restrictions on businesses and consumers appear to be growing more cautious. The Leading Economic Index (LEI) rose 2.0% during June, which is slightly slower than the 3.2% gain registered in May when many parts of the economy were beginning to re-open. In short, the economic recovery continues, but the pace of improvement looks to be slowing.

U.S. Outlook

Durable Goods Orders • Monday

Durable goods orders rebounded strongly in May, and we expect another solid bounce in June. The new orders component of the Institute for Supply Management (ISM) manufacturing index bounced 24.6 points in June to 56.4, the first expansion reading (a reading higher than 50) in 12 months. This rebound bodes well for a pick-up in durable goods orders. Transportation orders may lift the headline as vehicles & parts continue to rebound from recent lows, but aircraft orders will likely remain depressed. Data from Boeing showed only one new aircraft order in June, and when accounting for contractual changes and cancellations, Boeing saw negative net orders over the month. Core capital goods orders and shipments likely also continued to rebound. While these measures are useful for gauging business spending (reported for Q2 on Thursday), the steep declines at the onset of the quarter mean a weak Q2 outturn is pretty much a done deal.

Previous: 15.7% Wells Fargo: 6.4% Consensus: 7.0% (Month-over-Month)

Q2 GDP • Thursday

Real GDP data should show that output nosedived at an extraordinary rate of roughly 35% (annualized) in the second quarter. Every sector of the economy has been clobbered by the coronavirus crisis and accompanying containment measures. But recent monthly data suggest that the economy hit bottom in May as many states began to ease restrictions, and that GDP should bounce robustly in the third quarter. Risks to this call, however, are mounting. The reacceleration in COVID-19 case counts presents a serious downside risk to the economic recovery. High-frequency mobility data suggest activity began to stall out in mid-June, and if sustained this could weigh on the expected Q3-rebound. Our forecast remains predicated on the assumption that a generalized lockdown of the economy, such as what occurred in March and April does not occur, though localized set-backs, such as the re-imposition of business closures in California, may occur.

Previous: -5.0% Wells Fargo: -36.8% Consensus: -35.0% (Quarter-over-Quarter, Annualized)

Personal Income & Spending • Friday

We get the full personal income and spending report on Friday, which we expect to show personal spending rebounded 6.2% in June. Retail sales data rebounded strongly during the month, but recall, retail sales is mostly comprised of goods consumption and real goods spending was only about 1% off its pre-virus peak through May. Services spending has been hit particularly hard from stay-at-home orders, thus we are unlikely to see as pronounced a pick-up in personal spending as we have in the retail sales data.

Personal income likely fell 1.3% in June. While wage and salary income likely continued its recovery, government transfer payments are expected to weigh on the headline. Unemployment benefits and other government benefits (which included the economic impact payments) more than offset declines in employee compensation in recent months. Market attention remains on if direct support to households will be included in another round of fiscal stimulus.

Previous: -4.2%; 8.2% Wells Fargo: -1.3%; 6.2% Consensus: -0.8%; 5.3% (Inc; Spend, Month-over-Month)

Global Review

COVID-19 Outbreak Set to Disrupt Q2 Global Activity

- This week’s data releases offered more insight into the severity of the economic downturn resulting from the COVID-19 pandemic as well as subsequent lockdown and social distancing measures. South Korea—one of the first countries to release its Q2 GDP data—fell into recession with Q2 growth contracting 3.3% quarter-over-quarter.

- As COVID-19 cases continue to surge in South Africa, the South African Reserve Bank (SARB) opted to cut its repo rate for the fifth time, reducing the key rate 25 bps to 3.50%. Elsewhere, Eurozone manufacturing and services PMIs recovered more than expected in July, moving back into expansionary territory.

South Korea Q2 GDP Slumps

This week’s data releases offered more insight into the severity of the economic downturn resulting from the COVID-19 pandemic and subsequent lockdown and social distancing measures. We got the first glimpse into Q2 GDP growth data, with South Korea. The country’s economy fell into a recession in the first half of the year, with Q2 GDP tumbling 3.3% quarter-over-quarter, matching the decline in Q4-2008. South Korea’s economy is highly reliant on trade, and given the subdued state of the global economy, exports fell 16.6%, with significant decreases in motor vehicles and coal & petroleum products. Like other parts of the world, South Korea put lockdown and social distancing measures in place to contain the spread of the virus. However, as most restrictions have been lifted and the recovery gets underway, we look for a sharp rebound in South Korea’s economy in Q3-2020, which should also support the Korean won going forward.

SARB Cuts Rates for the Fifth Time

The South African Reserve Bank (SARB) opted to cut its repo rate for the fifth time, reducing the key rate 25 bps to 3.50%, its lowest level since it was introduced in 1998. The committee was divided on the decision with three of the five voting members in favor of a 25 bps cut, while two preferred no cut to the policy rate. In the accompanying statement, the central bank noted that the current environment remains highly uncertain, and that the strength of the global economic recovery will depend in part on the country’s ability to control new virus outbreaks. COVID-19 cases continue to surge in South Africa. The country already has over 408,000 confirmed cases, one of the highest case counts in the world.

The committee revised its domestic economic growth forecast lower, now seeing the South African economy contracting 7.3% for the full-year 2020, compared to its previous estimate of 7.0% in May, with the economy recovering in 2021 and 2022. It made little change to its inflation forecast, and expects inflation to stay within its target bank until 2022. As of now, we could see another rate cut from the SARB, but it appears the central bank is getting closer to the end of the easing cycle.

Eurozone PMIs Back in Expansionary Territory

This week’s release of the Eurozone manufacturing and services PMIs reinforced the idea that the worst of the COVID-19 related decline could be over for the region, and hinted that the bounce back in Q3-2020 could be faster than previously anticipated. The Eurozone’s PMIs rose more than expected in July, indicating expansion. The manufacturing PMI rose 3.7 points to 51.1, while the services PMI jumped nearly seven points to 55.1, the highest since mid-2018. The improvement reflects the relaxation of lockdown measures and increasing business re-openings throughout the region. Demand appears to have picked up, as new order inflows were reported to have risen for the first time since February. In addition, expectations of future output continued to improve in July, rising to a five-month high in both the manufacturing and service sectors. Both Germany and France recorded solid gains in their PMIs, moving back into expansionary territory. Notably, Germany’s services PMI rebounded 9.4 points to 56.7, while its manufacturing PMI rose to 50.0.

Global Outlook

Australian CPI • Tuesday

Australia’s headline CPI rose at the fastest pace since Q2-2014. Q1 inflation ticked up to 2.2% year-over-year, bouncing back into the Reserve Bank of Australia’s (RBA) target band of 2-3%. Large price increases in vegetables (+9.1%), pharmaceutical products (+5.1), secondary education (+3.4%) and tobacco (+2%) contributed to the increase. Despite the solid reading in Q1, some analysts look for Q2 prices to be weighed down by the sharp fall in oil prices and weak global demand.

The outlook for the overall Australian economy remains uncertain and will likely depend on the Australian government’s ability to contain the new COVID-19 outbreak that emerged in the nation’s most populated areas. We continue to look for Australia to enter its first recession since the early 1990s.

Previous: 2.2% Consensus: -0.5% (Year-over-Year)

Mexico GDP • Thursday

Mexico’s economy slumped in the first quarter of 2020 as social distancing and lockdown measures weighed on economic activity. Q1 GDP fell 1.2% quarter-over-quarter, after three consecutive declines in 2019, marking the first full year contraction since 2009. The Mexican economy has been under pressure for several years, but the spread of COVID-19 has intensified the slowdown. Q2 GDP growth is likely to be even worse. Although, activity and sentiment data remain bleak and are likely to weigh on overall growth, the AMLO administration has refused to deploy any meaningful spending packages to support the economy. Given Mexico’s limited fiscal stimulus response and COVID-19 disruptions, we downgraded our GDP forecast for Mexico and now look for the Mexican economy to contract 9.4% for the full-year 2020.

Previous: -1.2% (Quarter-over-Quarter)

Eurozone GDP • Friday

As COVID-19 intensified and governments enforced strict lockdown and social distancing measures in Italy, Germany, France and Spain, the Eurozone experienced a sharp contraction in Q1-2020, declining 3.6% quarter-over-quarter. German GDP fell 2.2%, while France, Spain and Italy fell around 5% or more. However, the prospects for the Eurozone economy have been more encouraging as new COVID- 19 cases continue to stabilize and activity and confidence indicators point to a less severe decline in Q2-2020 than previously anticipated. Confidence surveys rebounded more than expected in June, while hard activity data also improved more than expected with May retail sales jumping 17.8% month-over-month, the largest increase since the series began in 1999. Given the encouraging developments, we now look for a smaller Q2 GDP decline and a faster Q3 GDP rebound. We also adjusted our full-year 2020 outlook, and now forecast a smaller 7.7% GDP decline, compared to the 8.9% decline we previously saw.

Previous: -3.6% Wells Fargo: -10% Consensus: -12% (Quarter-over-Quarter)

Point of View

Interest Rate Watch

FOMC: Forward Guidance or YCC?

At its last meeting on June 10, the Federal Open Market Committee essentially pledged to do whatever it takes to revive the U.S. economy. Since then, an increase in COVID-19 cases has led many states to pause or, in some cases, rollback re-opening plans. Fed policymakers have become resigned to the reality that as renewed caution sweeps across the country, recent improvements in the economic data may prove fleeting.

Despite hand-wringing about the impending fallout from increased case counts in recent weeks, the economic data have not weakened materially, at least so far. The Fed is also close to wrapping up a review of its strategy, tools and communications that has been underway for a little over a year now. Therefore, we believe any formal shifts in policy in terms of forward guidance or yield curve control (YCC) are likely premature at the meeting which will wrap up on Wednesday.

That said, an adoption of “forward guidance” could be in the cards at subsequent meetings this year. The aim of forward guidance is to alter the public’s expectations of when the FOMC may eventually scale back support, helping to depress long-term interest rates. Forward guidance could come in the form of the FOMC pledging not to change course until a given date (calendar-based) or until key economic variables hit a certain value (threshold-based). More implicit would be using the “dot plot” to communicate where interest rates are headed over the next few years under “appropriate monetary policy.”

Yield curve control is another idea that is seriously under consideration, though we also doubt it will be implemented at this meeting. Still, the merits of YCC have been touted by various Fed speakers in recent weeks. It has had some desirable policy outcomes in economies where it has been tried. Capping yields at the front end of the curve à la the Reserve Bank of Australia could serve as extension of forward guidance while helping to keep the yield curve upward sloping. Most notably, YCC could lead to a slower expansion of the central bank’s balance sheet.

Credit Market Insights

State & Local Govs Still Struggling

While the Federal Reserve’s liquidity facilities and a general improvement in risk sentiment have dampened municipal bond market volatility, challenges remain for many state and local governments.

Revenue shortfalls and increased expenditures have put pressure on governments and agencies to finance operations. New York’s Metropolitan Transportation Authority (MTA), for instance, faces a four year, $16.2 billion deficit because of COVID-19 related decreases in ridership, increased costs associated with disinfecting public transportation and a decline in tax revenues.

The MTA is lobbying for an additional $10.4 billion in Federal COVID-19 relief in any upcoming stimulus bill in order to meet this and next year’s operating deficits, while simultaneously eyeing budget cuts of up to $350 million. Similarly, states are pursuing multiple avenues of financing their obligations. Illinois, the first state to borrow from the Federal Reserve’s Municipal Lending Facility (MLF), was able to borrow $1.2 billion at 3.82% after a May offering failed to draw lower rates from private investors.

However, inflows into Municipal Bond Mutual Funds have been a positive for potential issuers. After reaching a trough at the end of March, municipal issuance has also steadily ticked up, as yields for A through AAA rated bonds have declined. The spread between BBB and A bonds widened in April and has persisted, which will present an additional challenge for governments and agencies facing ratings downgrades in the wake of the crisis.

Topic of the Week

COVID-19 Looms Large Over Apartment Market

The COVID-19 crisis has exacerbated imbalances in the apartment market. The nation endured record declines in employment through March and April, as people stayed home to limit the spread of the virus and non-essential businesses were ordered to close. While the labor market has started to improve, a full recovery is far away and generally weak employment conditions are weighing on rental demand. Moreover, job losses thus far have been concentrated among hourly workers in the leisure & hospitality and retail industries, who disproportionately tend to be renters. The supply side is equally concerning. Over the past decade, there has been a boom in new apartment construction centered in a handful of dense urban areas in the major gateway markets and rapidly growing secondary markets. While new development has started to pull back, many of these markets are set for a wave of new supply as major projects are completed this year.

The growing imbalance between supply and demand is beginning to take a toll on rents. Since the onset of the COVID-19 crisis, landlords in many of the largest apartment markets have been slashing rents, according to data from CoStar. The trend is most evident in the relatively high-cost markets of San Francisco, New York City and Los Angeles. Rents have been more buoyant in Dallas-Fort Worth, Charlotte and Nashville. Even before the public health crisis, these areas had long been beneficiaries of residents and businesses fleeing highcost areas, a trend which is now supporting rents. Apartment rents in Miami, where COVID-19 cases continue to surge, appear to be sliding. Miami has seen a record number of units delivered over the past three years and has more on the way. In addition to a supply overhang, the Miami economy is in part driven by the battered international trade and tourism sectors, meaning demand will likely be slow to return.

Challenging times for apartment owners are likely to persist for some time. The bounce back in job growth in recent months has likely already subsided. Even though new apartment construction will surely slow, a deluge of new units are set to be delivered in coming months. We expect vacancy rates to rise over the next year and look for the slowdown in rent growth to continue, with highercost markets getting hit the hardest.

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals