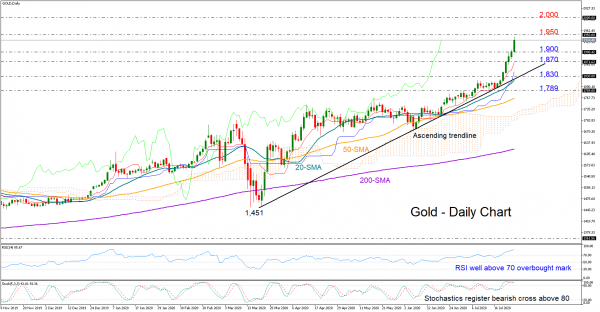

Gold stretched its unstoppable rally to uncharted territory on Monday and to a new top of 1,944 after easily surpassing the 2011 record high of 1,920.

A downside correction or some consolidation would not be a big surprise in the short-term as the market is trading well into the overbought zone according to the rising RSI and the Stochastics which have already registered a bearish cross above 80.

In this case, the 1,900 round number could immediately add footing under the price, deterring any move towards the supportive red Tenkan-sen line currently near 1,870. Beneath the latter, selling pressure could accelerate towards the ascending trendline and the 20-day simple moving average (SMA) both seen around 1,830, where any violation would likely suggest that a change in trend is at hand. Traders, however, could wait for a close below the swing low of 1,789 to confirm that the break is legitimate.

Should buyers remain in charge, breaching the 1,950 level too, the door would open for the 2,000 psychological mark.

All in all, gold is viewed as cautiously bullish. Bears could take control below 1,870, though only a close beneath the trendline and more importantly below 1,789 would be alarming for the market trend.

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals