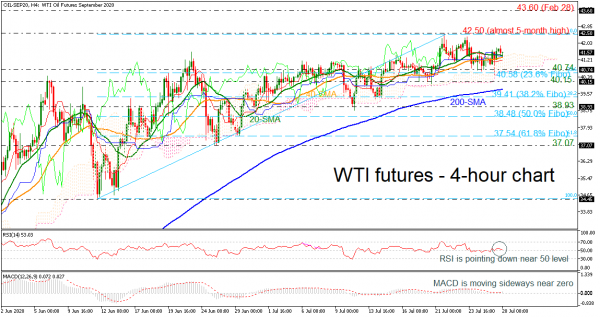

WTI crude oil futures have been on a sideline move after they reached an almost five-month peak around 42.50 in the preceding week. The price is flirting with the upper surface of the Ichimoku cloud and the short-term simple moving averages (SMAs) in the 4-hour chart.

Looking at the technical indicators, the RSI is holding near the 50 level, while the MACD is moving with weak momentum near its trigger and zero lines, both confirming the recent neutral trend.

In case the price remains above the 20- and 40-period SMAs, the market could hit the 42.50 resistance before edging higher towards the 43.60 barrier, taken from the high on February 28. Above that, the 48.80 obstacle registered on March 3 could next come in focus.

On the other hand, a downfall could find immediate support at the lower surface of the cloud at 40.74 and the 23.6% Fibonacci retracement level of the up leg from 34.45 to 42.50 at 40.58. Breaching these levels, the 40.15 support and the 200-period SMA at 39.80 could halt bearish movements before ahead of the 38.2% Fibo of 39.41.

Summarizing, WTI oil is in neutral mode in the very short-term, while in the bigger picture, the bullish tendency remains intact.

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals