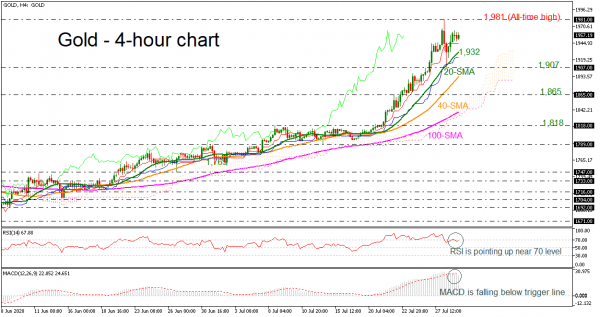

Gold maintains a horizontal trajectory pressed below the all-time high of 1,981 but is still in a strong bullish mode in the long-term picture. A paused state of directional momentum is reflected in the Ichimoku lines as the price rests near the red Tenkan-sen line.

The mixed signals in the short-term oscillators further reflect the stall in the price. The MACD has barely inched below its red trigger line in the positive region, while the RSI is improving its movement near the overbought zone.

If buyers manage to jump higher again, immediate resistance could come from the record high of 1,981 before the price heads for the psychological mark of 2,000.

Otherwise, if sellers drive the pair below the 20-period simple moving average (SMA) in the 4-hour chart, the 1,907 support could interrupt the commodity. In the event selling interest persists, another key support could be the 40-period SMA at 1,893. Should it fail to do so, the 1,865 number could challenge the price before the 100-period SMA currently at 1,840 comes to the rescue.

Summarizing, the precious metal maintains a strong bullish tendency in the longer-term view, and only a plunge beneath 1,747 may change this outlook.

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals