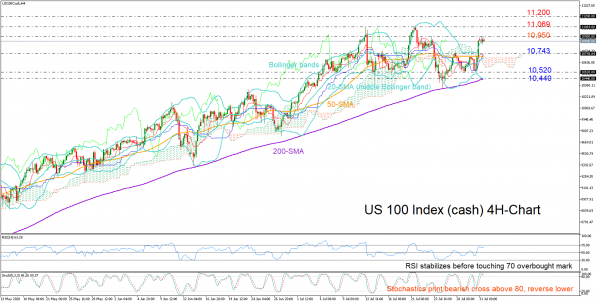

The US 100 stock index (cash) drifted higher and above the previous peak of 10,743 on Thursday, hinting that it is not ready to give up its positive trajectory yet.

The 10,950 resistance level is keeping the bulls busy in the four-hour chart today. Should it fail to hold, the index could advance towards its record highs registered around 11,069. At this point, it would be interesting to see if the market creates a bearish triple top formation or extends its uptrend to uncharted territory and towards the 11,200 psychological mark.

Technical signals, however, warrant some caution as the price is fluctuating around the upper Bollinger band and the Stochastics are reversing lower in the overbought area, suggesting that the bullish action may have reached a cliff.

Hence, downside movements cannot be ruled out, and in the event this happens near the 10,950 barrier, the price could correct lower to find support around the swing high of 10,743. Beneath that, selling orders may pick up steam towards the 10,520 base, while not far away, the 200-period simple moving average (SMA) at 10,440 could be crucial in maintaining confidence in the upward pattern.

Summarizing, the US 100 index is looking cautiously bullish near the 10,950 resistance area. Another upturn could send the price towards its recent record highs, while a drop below 10,743 could bring July’s lows into view.

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals