The US Dollar moved higher against all of its major pairs except for the CAD in late-day trading on Tuesday, gaining the most against the JPY. On the U.S. economic data front, the producer price index increased 0.6% in July on month, topping the 0.3% increase estimate from a decline of 0.2% in June signaling a slight recovery in the economy.

On Wednesday, the July budget deficit is likely to narrow from a June record of -$864.1 billion dollars to -$137.5 billion dollars. Consumer prices are estimated to increase 0.3% on month in July due to higher energy prices (0.7% on Year).

The Euro was bullish against all of its major pairs except for the CAD. In Europe, ZEW survey results of August were released for Germany (current situation at -81.3 vs -69.5, expectations at 71.5 vs 55.8 expected). The U.K. Office for National Statistics has reported ILO jobless rate for the three months to June at 3.9%, vs 4.2% expected.

The Australian dollar was under pressure against all of its major pairs with the exception of the JPY.

Gold dropped 121.14$ (-5.98%) to 1906.2.

VIX index jumped 1.83pt (+8.27%) to 23.96.

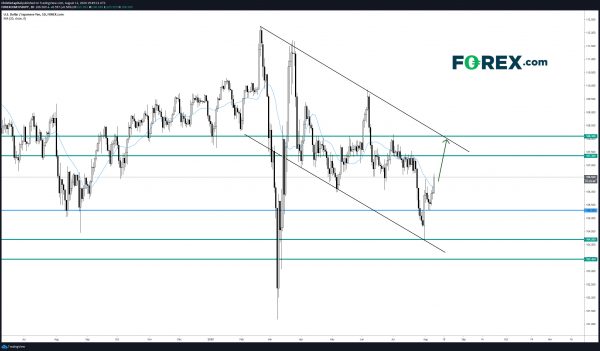

The USD/JPY jumped 56 pips to 106.52 in Tuesday’s trading. The pair remains inside a bearish channel. Price action is now back above the 20-day moving average. Look for a continuation of the rebound towards 108.10 resistance as long as 105.3 can hold as support.

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals