The S&P 500 Futures consolidate after they posted a strong rebound yesterday with tech shares gaining the most. Official data showed that U.S. Core Consumer Prices rose 0.6% on month in July, the largest gain since 1991.

Later today, the U.S. Labor Department will release July import price index (+0.6% on month expected) and initial jobless claims in the week ended August 8 (1.1 million expected).

European indices are facing a consolidation. The German Federal Statistical Office has posted final readings of July CPI at -0.1% year, as expected. France’s INSEE has reported 2Q jobless rate at 7.1% (vs 8.3% expected).

Asian indices consolidated except the Japanese Nikkei which closed in the green. Official data showed that the Australian economy added 114,700 jobs in July (+30,000 jobs expected), while jobless rate rose to 7.5% (7.8% expected) from 7.4% in June.

WTI Crude Oil futures remain on the upside. The U.S. Energy Information Administration reported a reduction of 4.51 million barrels in crude-oil stockpiles last week, much sharper than a reduction of 2.52 million barrels expected. Meanwhile, U.S. crude oil output decreased to 10.7 million barrels per day at the same week from 11.0 million barrels per day.

Gold rebounds, remaining firm above 1900 dollars, while the US dollar softens on doubts about US stimulus.

Gold rose 17.17 dollars (+0.9%) to 1933 dollars.

The dollar index fell 0.37pt to 93.076.

U.S. Equity Snapshot

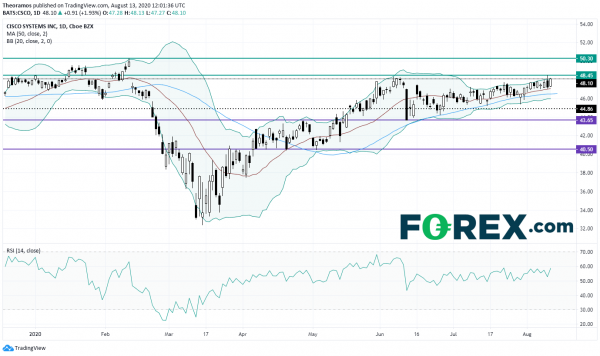

Cisco Systems (CSCO), a leading global supplier of network hardware and software, dropped after hours after saying it sees first quarter adjusted EPS in the range of 0.69 to 0.71 dollar, and sales down 9% to 11%. Those forecasts are below estimates. Separately, Cisco Systems reported fourth quarter earnings that topped expectations.

Source: TradingView, GAIN Capital

Lyft (LYFT), the ride-hailing service company, announced a second quarter LPS of 1.41 dollar compared to a loss of 0.68 dollar per share a year earlier on revenue of 339.3 million dollars compared to 867 million dollars a year ago.

Micron Technology (MU), a manufacturer of memory chips, was downgraded to “hold” from “buy” at Deutsche Bank.

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals